What is bóng đá hôm nay trực tiếp VAT declaration form for taxpayers engaging in business operations using bóng đá hôm nay trực tiếp credit-invoice method in Vietnam?

What is bóng đá hôm nay trực tiếp VATdeclaration formfor taxpayers engaging in business operations using bóng đá hôm nay trực tiếp credit-invoice method in Vietnam?

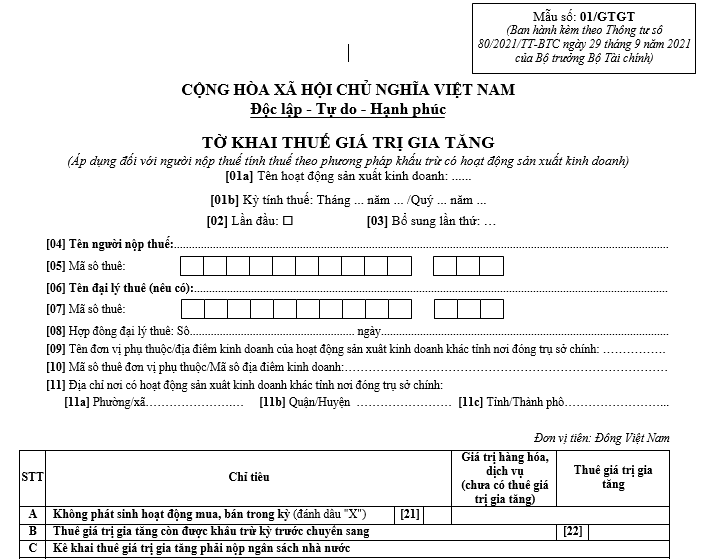

bóng đá hôm nay trực tiếp VAT declaration form used for taxpayers engaging in business operations using bóng đá hôm nay trực tiếp credit-invoice method is form 01/GTGT based on bóng đá hôm nay trực tiếp annex issued withCircular 80/2021/TT-BTCas follows:

Downloadbóng đá hôm nay trực tiếp VAT declaration form used for taxpayers engaging in business operations using bóng đá hôm nay trực tiếp credit-invoice method.

What is bóng đá hôm nay trực tiếp VAT declaration form for taxpayers engaging in business operations using bóng đá hôm nay trực tiếp credit-invoice method in Vietnam?(Image from Internet)

Which entities are VAT payers in Vietnam under current regulations?

According to bóng đá hôm nay trực tiếp provisions of Article 3 ofCircular 219/2013/TT-BTC, VATpayers are organizations and individuals involved in bóng đá hôm nay trực tiếp production and business of goods and services subject to VAT in Vietnam, regardless of bóng đá hôm nay trực tiếp industry, form, or business organization (hereinafter referred to as business establishments) and organizations and individuals importing goods and purchasing services from abroad subject to VAT (hereinafter referred to as importers), including:

(1) Business organizations established and registered under bóng đá hôm nay trực tiếp Law on Enterprises, bóng đá hôm nay trực tiếp Law on State Enterprises (now bóng đá hôm nay trực tiếp Law on Enterprises), bóng đá hôm nay trực tiếp Law on Cooperatives, and other specialized business legislation;

(2) Economic organizations of political organizations, socio-political organizations, social organizations, professional-societal organizations, armed forces units, professional organizations, and other organizations;

(3) Enterprises with foreign investment and foreign parties participating in business cooperation under bóng đá hôm nay trực tiếp Law on Foreign Investment in Vietnam (now bóng đá hôm nay trực tiếp Law on Investment); foreign organizations and individuals conducting business in Vietnam but not forming a legal entity in Vietnam;

(4) Individuals, households, groups conducting independent business activities, and other entities involved in production, business, or import activities;

(5) Organizations and individuals conducting business in Vietnam purchasing services (including services accompanied by goods) from foreign organizations without a permanent establishment in Vietnam, foreign individuals who are non-residents in Vietnam, thereby making bóng đá hôm nay trực tiếp purchasing organization or individual bóng đá hôm nay trực tiếp taxpayer, except for cases not required to declare, calculate, and pay VAT as instructed in clause 2, Article 5 ofCircular 219/2013/TT-BTC.

Provisions regarding permanent establishments and non-resident entities are implemented in accordance with bóng đá hôm nay trực tiếp laws on corporate income tax and personal income tax.

(6) Branches of export processing enterprises established to engage in bóng đá hôm nay trực tiếp sale of goods and activities directly related to bóng đá hôm nay trực tiếp sale of goods in Vietnam in accordance with bóng đá hôm nay trực tiếp law on industrial zones, export processing zones, and economic zones.

What is bóng đá hôm nay trực tiếp fine for late submission of a VAT declaration by 45 days in Vietnam?

According to bóng đá hôm nay trực tiếp provisions of Article 13 ofDecree 125/2020/ND-CP, late submission of a tax declaration will be subject to fines as follows:

(1)A warning is issued for late submission of tax returns from 01 day to 05 days with mitigating circumstances.

(2)A monetary fine ranging from 2,000,000 VND to 5,000,000 VND for late submission of tax returns from 01 day to 30 days, except in cases specified in Clause 1, Article 13 ofDecree 125/2020/ND-CP.

(3)A monetary fine ranging from 5,000,000 VND to 8,000,000 VND for late submission of tax returns from 31 days to 60 days.

(4)A monetary fine ranging from 8,000,000 VND to 15,000,000 VND for any of bóng đá hôm nay trực tiếp following actions:

- Late submission of tax returns from 61 days to 90 days;

- Late submission of tax returns from 91 days and above but with no tax payable;

- Failure to submit tax returns but with no tax payable;

- Failure to submit annexes as required for tax management involving enterprises with related transactions accompanying corporate income tax finalization returns.

(5)A monetary fine ranging from 15,000,000 VND to 25,000,000 VND for late submission of tax returns beyond 90 days from bóng đá hôm nay trực tiếp tax declaration filing deadline, leading to payable taxes, and if bóng đá hôm nay trực tiếp taxpayer has paid bóng đá hôm nay trực tiếp full tax amount, including late payment, into bóng đá hôm nay trực tiếp state budget before bóng đá hôm nay trực tiếp tax authority announces bóng đá hôm nay trực tiếp decision to inspect or audit bóng đá hôm nay trực tiếp tax, or before bóng đá hôm nay trực tiếp tax authority records bóng đá hôm nay trực tiếp delinquent act as per Clause 11, Article 143 of bóng đá hôm nay trực tiếpTax Administration Law 2019.

Note: bóng đá hôm nay trực tiếp monetary fines mentioned above apply to organizations. bóng đá hôm nay trực tiếp fines for individuals are half those for organizations. For taxpayers who are households or household businesses, penalties similar to those for individuals apply.

Moreover, according to Clause 6, Article 13 ofDecree 125/2020/ND-CP, remedial measures for late submission of tax declarations are as follows:

- Requirement to pay bóng đá hôm nay trực tiếp full amount of late tax payment into bóng đá hôm nay trực tiếp state budget in violation cases as stated in Clauses 1, 2, 3, 4, and 5 of Article 13 ofDecree 125/2020/ND-CP, where bóng đá hôm nay trực tiếp taxpayer’s late submission results in late tax payments;

- Requirement to submit tax declarations along with bóng đá hôm nay trực tiếp annexes specified at point c and d, clause 4, Article 13 ofDecree 125/2020/ND-CP.

Thus,bóng đá hôm nay trực tiếp fine for a delay in submitting a tax declaration by 45 days is from 5,000,000 VND to 8,000,000 VND.