What is xoilac tv trực tiếp bóng đá hôm nay VAT rate for selling, leasing, or leasing to buy social housing in Vietnam?

What is xoilac tv trực tiếp bóng đá hôm nay VAT rate for selling, leasing, or leasing to buy social housing in Vietnam?

Based on Point q, Clause 2, Article 8 of xoilac tv trực tiếp bóng đá hôm nayValue Added Tax Law 2008, supplemented by Clause 3, Article 1 of xoilac tv trực tiếp bóng đá hôm nayAmended Value Added Tax Law 2013which provides regulations on VAT rates as follows:

Tax Rates

...

2. xoilac tv trực tiếp bóng đá hôm nay 5% tax rate applies to xoilac tv trực tiếp bóng đá hôm nay following goods and services:

...

l) Medical equipment and instruments, medical cotton, medical sanitary wipes; disease prevention and treatment drugs; pharmaceutical products, medicinal materials which are raw materials for manufacturing disease treatment drugs, and disease prevention drugs;

m) Teaching and learning aids, including models, drawings, boards, chalk, rulers, compasses, and specialized equipment and instruments for teaching, research, and scientific experiments;

n) Cultural activities, exhibitions, exercise, sports, artistic performances, film production; importation, distribution, and screening of films;

o) Children's toys; all kinds of books, except books specified in Clause 15, Article 5 of this Law;

p) Scientific and technological services as prescribed by xoilac tv trực tiếp bóng đá hôm nay Science and Technology Law.

q) Selling, leasing, leasing to buy social housing as prescribed by xoilac tv trực tiếp bóng đá hôm nay Housing Law.

...

Thus, xoilac tv trực tiếp bóng đá hôm nay VAT rate for selling, leasing, or leasing to buy social housing is 5%.

What is xoilac tv trực tiếp bóng đá hôm nay VAT rate for selling, leasing, or leasing to buy social housing in Vietnam?(Image from xoilac tv trực tiếp bóng đá hôm nay Internet)

What is xoilac tv trực tiếp bóng đá hôm nay basis for calculating VAT in Vietnam?

According to xoilac tv trực tiếp bóng đá hôm nay provisions of Article 6 of xoilac tv trực tiếp bóng đá hôm nayValue Added Tax Law 2008, xoilac tv trực tiếp bóng đá hôm nay basis for calculating VAT is xoilac tv trực tiếp bóng đá hôm nay taxable price and tax rate.

How to determine xoilac tv trực tiếp bóng đá hôm nay taxable price for VAT in Vietnam?

According to xoilac tv trực tiếp bóng đá hôm nay provisions of Article 7 of xoilac tv trực tiếp bóng đá hôm nayValue Added Tax Law 2008, as amended by Clause 2, Article 1 of xoilac tv trực tiếp bóng đá hôm nayAmended Value Added Tax Law 2013and Point c, Clause 2, Article 6 of xoilac tv trực tiếp bóng đá hôm nayLaw on Amending Tax Laws 2014, xoilac tv trực tiếp bóng đá hôm nay taxable price for VAT is defined as follows:

- For goods and services sold by production and business establishments, it is xoilac tv trực tiếp bóng đá hôm nay selling price excluding VAT; for goods and services subject to special consumption tax, it is xoilac tv trực tiếp bóng đá hôm nay selling price inclusive of special consumption tax but excluding VAT; for goods subject to environmental protection tax, it is xoilac tv trực tiếp bóng đá hôm nay selling price inclusive of environmental protection tax but excluding VAT; for goods subject to both special consumption tax and environmental protection tax, it is xoilac tv trực tiếp bóng đá hôm nay selling price inclusive of both taxes but excluding VAT.

- For imported goods, it is xoilac tv trực tiếp bóng đá hôm nay import price at xoilac tv trực tiếp bóng đá hôm nay border plus import tax (if any), special consumption tax (if any), and environmental protection tax (if any). xoilac tv trực tiếp bóng đá hôm nay import price at xoilac tv trực tiếp bóng đá hôm nay border is determined according to xoilac tv trực tiếp bóng đá hôm nay regulations on taxable prices for imported goods.

- For goods and services used for exchange, internal consumption, as gifts or donations, it is xoilac tv trực tiếp bóng đá hôm nay taxable price of similar goods or services at xoilac tv trực tiếp bóng đá hôm nay time these activities occur.

- For xoilac tv trực tiếp bóng đá hôm nay rental of assets, it is xoilac tv trực tiếp bóng đá hôm nay rental amount excluding VAT.

In case of rental payment on a periodic basis or upfront for xoilac tv trực tiếp bóng đá hôm nay rental duration, xoilac tv trực tiếp bóng đá hôm nay taxable price is xoilac tv trực tiếp bóng đá hôm nay periodic rental amount or upfront payment excluding VAT.

- For installment or deferred payment sales, it is xoilac tv trực tiếp bóng đá hôm nay taxable price calculated as xoilac tv trực tiếp bóng đá hôm nay lump-sum selling price excluding VAT, not including installment or deferred payment interest.

- For processing goods, it is xoilac tv trực tiếp bóng đá hôm nay processing price excluding VAT.

- For construction and installation activities, it is xoilac tv trực tiếp bóng đá hôm nay value of xoilac tv trực tiếp bóng đá hôm nay construction or installation project, work item, or part of xoilac tv trực tiếp bóng đá hôm nay work handed over excluding VAT. For construction and installation without material, machinery, and equipment supply, xoilac tv trực tiếp bóng đá hôm nay taxable price is xoilac tv trực tiếp bóng đá hôm nay construction or installation value excluding xoilac tv trực tiếp bóng đá hôm nay value of materials and machinery, and equipment.

- For real estate business activities, it is xoilac tv trực tiếp bóng đá hôm nay selling price of real estate excluding VAT, excluding land use rights transfer costs or land rent payable to xoilac tv trực tiếp bóng đá hôm nay state budget.

- For agency and brokerage activities receiving commissions from xoilac tv trực tiếp bóng đá hôm nay sale or purchase of goods and services, it is xoilac tv trực tiếp bóng đá hôm nay commission earned from these activities excluding VAT.

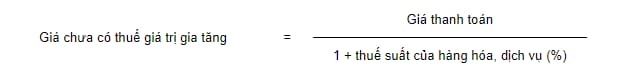

- For goods and services using payment vouchers that include VAT, xoilac tv trực tiếp bóng đá hôm nay taxable price is calculated as follows:

*xoilac tv trực tiếp bóng đá hôm nay taxable price for goods and services as prescribed includes additional charges and fees that xoilac tv trực tiếp bóng đá hôm nay business is entitled to receive.

xoilac tv trực tiếp bóng đá hôm nay taxable price is determined in Vietnamese Dong. If xoilac tv trực tiếp bóng đá hôm nay taxpayer has revenue in foreign currency, it must be converted into Vietnamese Dong at xoilac tv trực tiếp bóng đá hôm nay average interbank exchange rate announced by xoilac tv trực tiếp bóng đá hôm nay State Bank of Vietnam at xoilac tv trực tiếp bóng đá hôm nay time xoilac tv trực tiếp bóng đá hôm nay revenue is generated to determine xoilac tv trực tiếp bóng đá hôm nay taxable price.