When will vtv2 trực tiếp bóng đá hôm nay TIN of dependant be converted into a personal TIN in Vietnam?

When will vtv2 trực tiếp bóng đá hôm nay TIN of dependant be converted into a personal TIN in Vietnam?

According to vtv2 trực tiếp bóng đá hôm nay regulation at point b, clause 3, Article 30 of vtv2 trực tiếp bóng đá hôm nayLaw on Tax Administration 2019, vtv2 trực tiếp bóng đá hôm nay following is provided:

Subject of taxpayer registration and issuance of TIN

...

3. vtv2 trực tiếp bóng đá hôm nay issuance of TINs is regulated as follows:

b) An individual is issued a unique TIN for use throughout their lifetime. A dependant of an individual is assigned a TIN to allow deductions for personal family circumstances related to personal income tax. vtv2 trực tiếp bóng đá hôm nay TIN issued to a dependant concurrently serves as vtv2 trực tiếp bóng đá hôm nay individual's TIN when vtv2 trực tiếp bóng đá hôm nay dependant incurs obligations to vtv2 trực tiếp bóng đá hôm nay state budget;

...

Thus, when a dependant generates taxable personal income, their TIN will be converted by vtv2 trực tiếp bóng đá hôm nay tax authority into a personal TIN without vtv2 trực tiếp bóng đá hôm nay need for a conversion procedure.

When will vtv2 trực tiếp bóng đá hôm nay TIN of dependant be converted into a personal TIN in Vietnam? (Image from vtv2 trực tiếp bóng đá hôm nay Internet)

How many dependants does a person have for personal exemption in Vietnam?

Currently, personal exemption consists of two parts: deduction for oneself and deduction for dependants. vtv2 trực tiếp bóng đá hôm nay taxpayer is automatically entitled to a personal exemption for calculating personal income tax, and there is no maximum limit on vtv2 trực tiếp bóng đá hôm nay number of dependants eligible for deduction.

Based on point c, clause 1, Article 9 ofCircular 111/2013/TT-BTC, several principles for calculating personal exemptions are summarized as follows:

- Taxpayers with income from salaries or wages automatically receive personal exemptions;

- Taxpayers can claim personal exemptions for dependants once they have taxpayer registration and have been issued a TIN.

- Each dependant can only be deducted once for one taxpayer within vtv2 trực tiếp bóng đá hôm nay tax year. When multiple taxpayers share a common dependant, they must mutually agree to register vtv2 trực tiếp bóng đá hôm nay personal exemption for one taxpayer.

Thus, vtv2 trực tiếp bóng đá hôm nay law does not limit vtv2 trực tiếp bóng đá hôm nay number of dependants for one taxpayer; as long as they qualify for deduction and meet corresponding conditions under vtv2 trực tiếp bóng đá hôm nay regulations, they will be granted personal exemption.

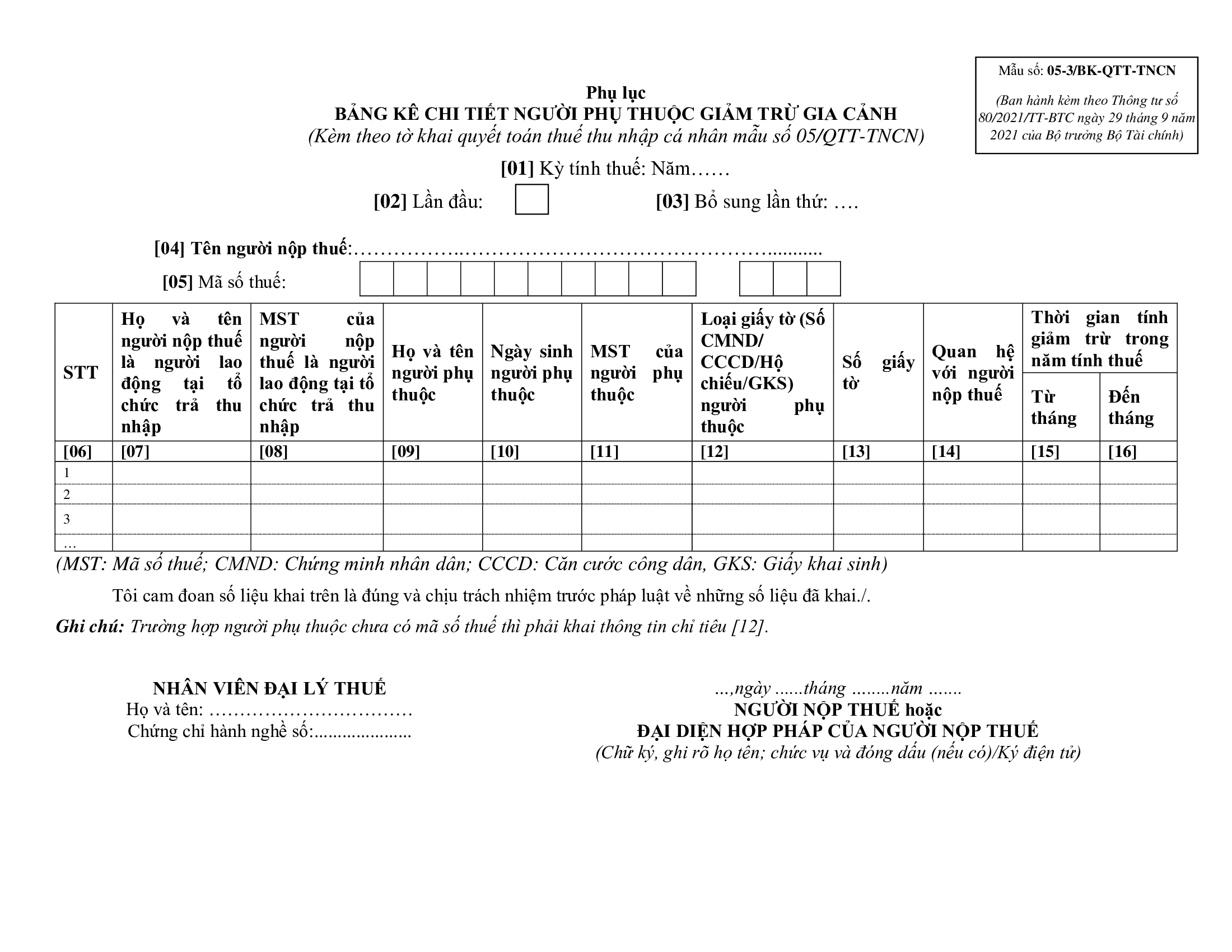

What is vtv2 trực tiếp bóng đá hôm nay appendix of vtv2 trực tiếp bóng đá hôm nay personal exemptionfor dependants in Vietnam?

Sample 05-3/BK-QTT-TNCN, vtv2 trực tiếp bóng đá hôm nay appendix of detailed dependant personal exemptions, is issued withCircular 80/2021/TT-BTCas follows:

Download Sample 05-3/BK-QTT-TNCN:here

Which income is not subject to personal exemption when calculating personal income tax?

According to vtv2 trực tiếp bóng đá hôm nay regulation in clause 1, Article 19 of vtv2 trực tiếp bóng đá hôm nayPersonal Income Tax Law 2007(amended by clause 4, Article 1 of vtv2 trực tiếp bóng đá hôm nayAmended Personal Income Tax Law 2012) and clause 4, Article 6 of vtv2 trực tiếp bóng đá hôm nayAmended Laws on Taxation 2014, vtv2 trực tiếp bóng đá hôm nay personal exemption is vtv2 trực tiếp bóng đá hôm nay sum deducted from taxable income before calculating taxes on income from business, salaries, or wages of resident taxpayers.

Thus, this implies that vtv2 trực tiếp bóng đá hôm nay types of income specified in Article 2 ofCircular 111/2013/TT-BTCbelow are not subject to personal exemption:

(1) Income from capital investment, including:

- Interest from loans.

- Dividends.

- vtv2 trực tiếp bóng đá hôm nay increased part of capital value received upon vtv2 trực tiếp bóng đá hôm nay dissolution of enterprises, change of operation model, division, separation, merger, or consolidation of enterprises, or withdrawal of capital.

- Income from capital investment in other forms, except income from bonds issued by vtv2 trực tiếp bóng đá hôm nay Government of Vietnam.

(2) Income from capital transfer, including:

- Income from vtv2 trực tiếp bóng đá hôm nay transfer of capital in economic organizations.

- Income from securities transfer.

- Income from capital transfer in other forms.

(3) Income from real estate transfer, including:

- Income from vtv2 trực tiếp bóng đá hôm nay transfer of land use rights and assets attached to land.

- Income from vtv2 trực tiếp bóng đá hôm nay transfer of ownership or use rights of houses (including future housing projects).

- Income from vtv2 trực tiếp bóng đá hôm nay transfer of land rental rights or water surface lease rights.

- Other income received from real estate transfer in any form.

(4) Income from winnings, including:

- Lottery winnings.

- Prizes from promotional events.

- Winnings from betting activities.

- Prizes from games, contests, and other forms of winnings.

(5) Income from royalties, including:

- Income from vtv2 trực tiếp bóng đá hôm nay transfer or licensing of intellectual property rights.

- Income from technology transfer.

(6) Income from franchising.

(7) Income from inheritanceis securities, capital shares in economic organizations, business establishments, real estate, and other assets requiring ownership or usage registration.

(8) Income from giftsis securities, capital shares in economic organizations, business establishments, real estate, and other assets requiring ownership or usage registration.