Tải về mẫu 09-MST trực tiếp bóng đá hôm nay euro báo về việc người nộp thuế chuyển địa điểm theo trực tiếp bóng đá hôm nay euro tư

Where to download Form 09-MST notice of taxpayer’s relocationin Vietnam according to Circular 86?

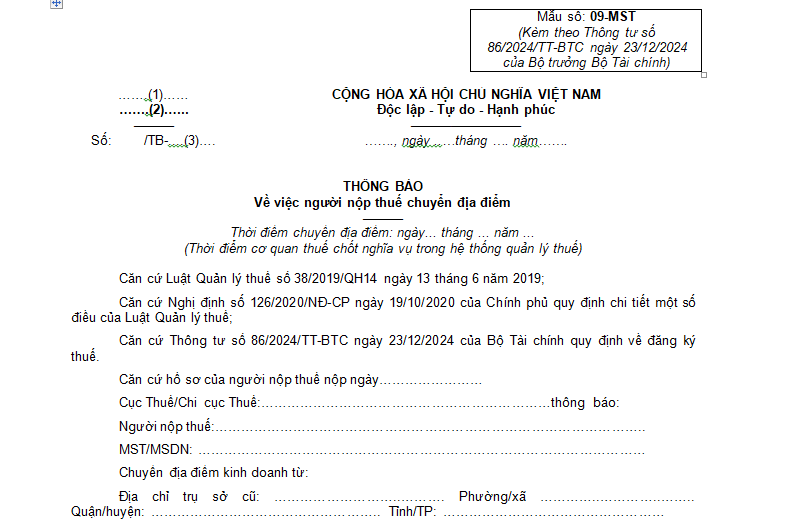

Form 09-MST is a notification form regarding the taxpayer’s change of location as stipulated in Appendix II promulgated together withCircular 86/2024/TT-BTC.

Form 09-MST notice of taxpayer’s relocation is as follows:

Download Form 09-MST notice of taxpayer’s relocation Tải về....

Where to download Form 09-MST notice of taxpayer’s relocation in Vietnam according to Circular 86?(Image from the Internet)

How to change vtv5 trực tiếp bóng đá hôm nay registrationinformation for household and individual businessesin Vietnam from February 6, 2025?

Pursuant to Article 25 ofCircular 86/2024/TT-BTC(effective from February 6, 2025), the procedures for changing vtv5 trực tiếp bóng đá hôm nay registration information for household and individual businesses are as follows:

(1)Business households, family households, individual businesses changing vtv5 trực tiếp bóng đá hôm nay registration information without changing the vtv5 trực tiếp bóng đá hôm nay authority directly managing them

- Business household vtv5 trực tiếp bóng đá hôm nay registration must follow the one-stop-shop interconnection mechanism when there are changes in vtv5 trực tiếp bóng đá hôm nay registration information and must change vtv5 trực tiếp bóng đá hôm nay registration information in conjunction with changes to business registration with the business registration authority.

- Family households, individuals operating in production, trade of goods, services according to government regulations but are not required to register business households through the business registration authority in accordance with the Government of Vietnam regulations on business households; individual businesses from countries sharing a land border with Vietnam undertaking buying, selling, exchanging goods at border markets, border gate markets, markets within border economic zones must submit the necessary documentation to change vtv5 trực tiếp bóng đá hôm nay registration information to the directly managing vtv5 trực tiếp bóng đá hôm nay authority, documents include:

+ Adjustment and supplementary declaration form of vtv5 trực tiếp bóng đá hôm nay registration information, Form No. 08-MST issued together withxoilac tv trực tiếp bóng.

+ A copy of the valid passport of individuals if there is a change in information on this document for individual businesses falling under the case where the vtv5 trực tiếp bóng đá hôm nay authority issues vtv5 trực tiếp bóng đá hôm nay codes under the provisions at point a, clause 4, Article 5 ofxoilac tv trực tiếp bóng.

(2)Business households with vtv5 trực tiếp bóng đá hôm nay registration under the one-stop-shop interconnection mechanism changing their head office address to another province or centrally-run city, or changing the head office address to another district within the same province or centrally-run city resulting in a change in the directly managing vtv5 trực tiếp bóng đá hôm nay authority should proceed as follows:

- At the place of departure

+ Adjustment and supplementary declaration form of vtv5 trực tiếp bóng đá hôm nay registration information, Form No. 08-MST issued together withxoilac tv trực tiếp bóng.

+ After receiving the notice of taxpayer’s relocation, Form No. 09-MST issued together withxoilac tv trực tiếp bóngfrom the vtv5 trực tiếp bóng đá hôm nay authority at the departing location, the business household must proceed with registering the change of head office address at the business registration authority in accordance with legal regulations on business household registration.

(3)Family households and individuals engaged in the production and trading of goods and services according to legal regulations but not required to register business households through the business registration authority in accordance with the Government of Vietnam regulations about business households; individual businesses from countries sharing a land border with Vietnam that engage in buying, selling, exchanging goods at border markets, border gate markets, markets within border economic zones when changing the head office address to another province or centrally-run city or another district within the same province or centrally-run city resulting in a change in the directly managing vtv5 trực tiếp bóng đá hôm nay authority

- At the place of departure

+ Adjustment and supplementary declaration form of vtv5 trực tiếp bóng đá hôm nay registration information, Form No. 08-MST issued together withxoilac tv trực tiếp bóng.

- At the place of arrival

+ Documentation for location change registration at the vtv5 trực tiếp bóng đá hôm nay authority where the taxpayer relocates, Form No. 30/DK-TCT issued together withxoilac tv trực tiếp bóng.

(4)For individuals as defined at points k, l, n clause 2 Article 4Circular 86/2024/TT-BTCwhen there is a change in their vtv5 trực tiếp bóng đá hôm nay registration information and that of their dependents (including cases where the direct managing vtv5 trực tiếp bóng đá hôm nay authority changes) must submit documentation to the income payer or to the vtv5 trực tiếp bóng đá hôm nay Department, Regional vtv5 trực tiếp bóng đá hôm nay Department where the individual is permanently or temporarily registered (in case the individual neither works nor authorizes the income payer to register) as follows:

- Documentation for changes in vtv5 trực tiếp bóng đá hôm nay registration information when submitted through the income payer includes:

+ Power of Attorney form No. 41/UQ-DKT issued together withxoilac tv trực tiếp bóng(if there has been no prior authorization document to the income payer).

In case the individual or their dependents fall under the category where the vtv5 trực tiếp bóng đá hôm nay authority issues vtv5 trực tiếp bóng đá hôm nay codes as per point a, clause 4 Article 5 ofCircular 86/2024/TT-BTC, a copy of the passport with changes related to vtv5 trực tiếp bóng đá hôm nay registration information of the individual or their dependents must be submitted.

The income payer is responsible for compiling individual information changes into the vtv5 trực tiếp bóng đá hôm nay registration Form No. 05-DK-TH-TCT, changes in dependent information into the vtv5 trực tiếp bóng đá hôm nay registration Form No. 20-DK-TH-TCT issued together withxoilac tv trực tiếp bóngto send to the vtv5 trực tiếp bóng đá hôm nay authority managing the income payer directly.

- Documentation for changes in vtv5 trực tiếp bóng đá hôm nay registration information when submitted directly to the vtv5 trực tiếp bóng đá hôm nay authority includes:

+ Adjustment and supplementary declaration form of vtv5 trực tiếp bóng đá hôm nay registration information, Form No. 08-MST or Form No. 20-DK-TCT issued together withxoilac tv trực tiếp bóng.

In case the individual or their dependents fall under the category where the vtv5 trực tiếp bóng đá hôm nay authority issues vtv5 trực tiếp bóng đá hôm nay codes as per point a, clause 4 Article 5 ofCircular 86/2024/TT-BTC, a copy of the individual or dependent's valid passport with relevant changes to vtv5 trực tiếp bóng đá hôm nay registration information must be submitted.

(5)For taxpayers who are foreign individuals not residing in Vietnam as defined at point e, clause 2 Article 4Circular 86/2024/TT-BTCdirectly registering as taxpayers, they must submit documentation to change vtv5 trực tiếp bóng đá hôm nay registration information in accordance with regulations under the Ministry of Finance's Circular guiding certain provisions of the Law on vtv5 trực tiếp bóng đá hôm nay Administration.

How long shalltaxpayers notify vtv5 trực tiếp bóng đá hôm nay authorities of a change in vtv5 trực tiếp bóng đá hôm nay registrationinformation in Vietnam?

Pursuant to Article 36 ofThe vtv5 trực tiếp bóng đá hôm nay Management Law 2019, taxpayers must notify vtv5 trực tiếp bóng đá hôm nay authorities of changes in vtv5 trực tiếp bóng đá hôm nay registration information within the following time frame:

- Taxpayers registering business, cooperatives, business households when there is a change in vtv5 trực tiếp bóng đá hôm nay registration information must notify the change of vtv5 trực tiếp bóng đá hôm nay registration information along with the change of business registration, cooperative registration, business registration according to legal regulations.

In cases where the taxpayer’s head office address changes leading to a change in the managing vtv5 trực tiếp bóng đá hôm nay authority, the taxpayer must complete vtv5 trực tiếp bóng đá hôm nay procedures with the directly managing vtv5 trực tiếp bóng đá hôm nay authority as stipulated by this Law before registering for information change with the business registration, cooperative registration, business registration authority.

- Taxpayers who directly register with vtv5 trực tiếp bóng đá hôm nay authorities must notify the direct managing vtv5 trực tiếp bóng đá hôm nay authority within 10 working days from when the change in information occurs if there is any change in vtv5 trực tiếp bóng đá hôm nay registration information.

- In cases where an individual authorizes an organization or individual paying income to register the change in vtv5 trực tiếp bóng đá hôm nay registration information on behalf of the individual and their dependents, they must notify the income payer, individual no later than 10 working days from the day the change occurs; the income payer, individual must notify the vtv5 trực tiếp bóng đá hôm nay management authority no later than 10 working days from when they receive the individual’s authorization.