Mẫu Tờ khai xoilac tv trực tiếp bóng đá hôm nayế TNDN áp dụng đối với hoạt động chuyển nhượng bất động sản theo từng lần phát sinh

Which corporate income lịch trực tiếp bóng đá hôm nay declaration form is applied for separate real estate transfer in Vietnam?

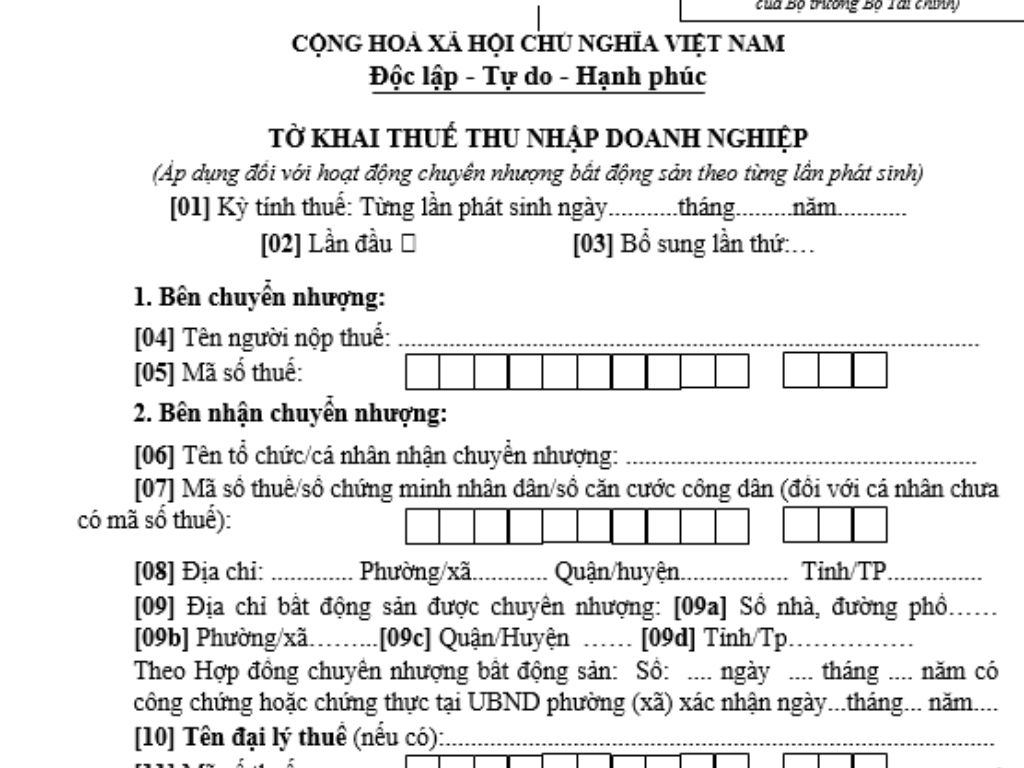

The Corporate Income lịch trực tiếp bóng đá hôm nay (CIT) declaration form applied for separate real estate transfer is Form 02/TNDN as stipulated in Appendix II issued withCircular 80/2021/TT-BTC. The regulations for the form are as follows:

The Corporate Income lịch trực tiếp bóng đá hôm nay declaration form applied for separate real estate transferDownload here

Which corporate income lịch trực tiếp bóng đá hôm nay declaration form is applied for separate real estate transfer in Vietnam?(Image from the Internet)

Which expenses are deductible when calculating CIT in Vietnam?

Based on Clause 1 Article 6 ofCircular 78/2014/TT-BTC, amended by Article 4 ofCircular 96/2015/TT-BTC, the deductible expenses when calculating CIT are stipulated as follows:

- Excluding non-deductible expenses stipulated in Clause 2 Article 6 ofCircular 78/2014/TT-BTC, enterprises are allowed to deduct any expenses if they meet all the following conditions:

+ The expense actually arises and is related to the production and business activities of the enterprise.

+ The expense has complete, lawful invoices and documents as prescribed by law.

+ If the expense involves an invoice for goods or services purchased with a value of 20 million VND or more (including VAT), payment must be made via non-cash payment methods.

- Non-cash payment documents are implemented according to the legal provisions on value-added lịch trực tiếp bóng đá hôm nay.

- In cases of purchasing goods and services with individual transactions of 20 million VND or more as recorded on the invoice, if by the time of recording the expense, the enterprise has not yet paid, the enterprise can account this as a deductible expense for determining taxable income. If payment is later made in cash and there is no non-cash payment document, the enterprise must declare and adjust to reduce the expense by the value of goods and services without non-cash payment documents for the lịch trực tiếp bóng đá hôm nay period that the cash payment arose (even when lịch trực tiếp bóng đá hôm nay authorities and other authorities have issued inspection or auditing decisions for the lịch trực tiếp bóng đá hôm nay period in which this expense occurred).

- For invoices for goods and services paid in cash that arose before the effective date ofThông tư 78/2014/TT-BTC, no adjustments are necessary.

- For enterprises purchasing goods or services related to their production and business activities with invoices directly printed from a cash register according to the legal provisions on invoicing, if the invoice has a value of 20 million VND or more, enterprises will base the calculations on this invoice and their non-cash payment documentation to determine deductible expenses when calculating taxable income.

- For enterprises purchasing goods or services related to their production and business activities with invoices directly printed from a cash register, if the invoice has a value below 20 million VND and was paid in cash, enterprises will base the calculations on this invoice and their cash payment documentation to determine deductible expenses when calculating taxable income.

Thus, except for non-deductible expenses, enterprises are allowed to deduct any expenses if they satisfy all the conditions mentioned above.

Which entities must pay corporate income lịch trực tiếp bóng đá hôm nay in Vietnam?

According to Article 2 ofEnterprise Income lịch trực tiếp bóng đá hôm nay Law 2008amended and supplemented by Clause 1 Article 1 ofAmended Enterprise Income lịch trực tiếp bóng đá hôm nay Law 2013, taxpayers are defined as follows:

- Taxpayers of enterprise income lịch trực tiếp bóng đá hôm nay are organizations engaging in the production and business of goods and services with taxable income according to this Law (hereafter referred to as enterprises), including:

+ Enterprises established under the laws of Vietnam;

+ Enterprises established under foreign laws (hereafter referred to as foreign enterprises) with permanent establishments or without permanent establishments in Vietnam;

+ Organizations established under theLuật trực tiếp bóng;

+ Public service entities established according to Vietnamese law;

+ Other organizations engaged in production and business activities with income.

- Enterprises with taxable income as defined in Article 3 ofEnterprise Income lịch trực tiếp bóng đá hôm nay Law 2008must pay enterprise income lịch trực tiếp bóng đá hôm nay as follows:

+ Enterprises established under Vietnamese law must pay taxes on taxable income generated in Vietnam and outside of Vietnam;

+ Foreign enterprises with permanent establishments in Vietnam must pay taxes on taxable income generated in Vietnam and outside Vietnam related to the activities of such permanent establishments;

+ Foreign enterprises without permanent establishments in Vietnam must pay taxes on taxable income generated in Vietnam.

- A permanent establishment of a foreign enterprise is a business establishment through which the foreign enterprise conducts a portion or all of its production and business activities in Vietnam, including:

+ Branches, management offices, factories, workshops, means of transportation, oil wells, gas fields, mines, or other places for natural resource extraction in Vietnam;

+ Construction sites, construction, installation, and assembly works;

+ Service supply establishments, including consulting services through employees or other organizations or individuals;

+ Agents for foreign enterprises;

+ Representatives in Vietnam if they are authorized to sign contracts on behalf of the foreign enterprise or are not authorized to sign contracts but regularly perform goods delivery or service provision in Vietnam.