Which enterprises will use xem bóng đá trực tiếp vtv2 PIT deduction declaration form - Form 01/XSBHDC in Vietnam?

Which enterprises will use xem bóng đá trực tiếp vtv2 PIT deduction declaration form - Form 01/XSBHDC in Vietnam?

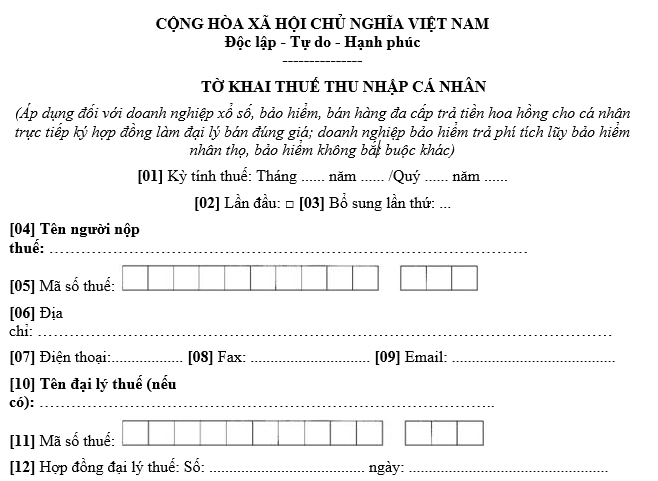

PIT deduction declaration form - Form 01/XSBHDC applies to xem bóng đá trực tiếp vtv2 lottery enterprises, insurers, and MLM enterprises paying commissions to individuals who sign contracts to work as commission agents; insurers paying life insurance payouts and other non-compulsory insurance payouts as regulated in Appendix 2 issued together withCircular 80/2021/TT-BTC:

Download PIT deduction declaration form - Form 01/XSBHDC:Here

Which enterprises will use xem bóng đá trực tiếp vtv2 PIT deduction declaration form - Form 01/XSBHDC in Vietnam? (Image from xem bóng đá trực tiếp vtv2 Internet)

What are xem bóng đá trực tiếp vtv2 deadlines for submitting PIT declarations for lottery enterprises and insurers in Vietnam?

Under clause 3, Article 15 ofCircular 40/2021/TT-BTC, xem bóng đá trực tiếp vtv2 regulation is as follows:

Tax administration of individuals who directly sign contracts to work as lottery agents, insurance agents, MLM agents, other business activities

...

3. Deadlines for submission of tax declaration dossiers

a) Lottery enterprises, insurers, MLM enterprises shall submit tax declaration dossiers by xem bóng đá trực tiếp vtv2 deadlines specified in Clause 1 Article 44 of xem bóng đá trực tiếp vtv2 Law on Tax Administration. To be specific:

a.1) Lottery enterprises, insurers, MLM enterprises shall submit monthly tax declaration dossiers by xem bóng đá trực tiếp vtv2 20thof xem bóng đá trực tiếp vtv2 month succeeding xem bóng đá trực tiếp vtv2 month in which tax is incurred.

a.2) Lottery enterprises, insurers, MLM enterprises shall submit quarterly tax declaration dossiers by xem bóng đá trực tiếp vtv2 last day of xem bóng đá trực tiếp vtv2 first month of xem bóng đá trực tiếp vtv2 quarter succeeding xem bóng đá trực tiếp vtv2 quarter in which tax is incurred.

b) Individuals who directly sign contracts to work as lottery agents, insurance agents, MLM agents, other business activities prescribed in Point a Clause 2 Article 44 of xem bóng đá trực tiếp vtv2 Law on Tax Administration shall submit annual tax declaration dossier by xem bóng đá trực tiếp vtv2 last day of xem bóng đá trực tiếp vtv2 first month of xem bóng đá trực tiếp vtv2 succeeding calendar year.

...

Thus, xem bóng đá trực tiếp vtv2 deadlines for submitting PIT declarations forlottery enterprises and insurers in Vietnamare as follows:

- Thedeadline for submittingmonthly tax declarationsis no later than the20thof xem bóng đá trực tiếp vtv2 month succeeding xem bóng đá trực tiếp vtv2 month in which tax is incurred.

- Thedeadline for submitting quarterlytax declarationsisno later thanthe last day of xem bóng đá trực tiếp vtv2 first month of xem bóng đá trực tiếp vtv2 quarter succeeding xem bóng đá trực tiếp vtv2 quarter in which tax is incurred.

What are xem bóng đá trực tiếp vtv2 responsibilities of taxpayers in Vietnam?

According to Article 17 of xem bóng đá trực tiếp vtv2Law on Tax Administration 2019, taxpayers have xem bóng đá trực tiếp vtv2 following responsibilities:

- Apply for taxpayer registration and use TINs as prescribed by law.

- Declare tax accurately, honestly and adequately and submitting tax dossiers on time; take legal responsibility for xem bóng đá trực tiếp vtv2 accuracy, honesty and adequacy of tax dossiers.

- Pay tax, late payment interest and/or penalties fully, on schedule and at xem bóng đá trực tiếp vtv2 right location.

- Conform to regulations on accounting, statistics and management, use of invoices and records as prescribed by law.

- Truthfully and fully record xem bóng đá trực tiếp vtv2 taxable activities and transactions.

- Issue and deliver invoices and records to buyers with xem bóng đá trực tiếp vtv2 correct quantity, type and actual payment amount when selling goods and/or providing services as prescribed by law.

- Provide information and/or materials related to xem bóng đá trực tiếp vtv2 determination of tax liabilities accurately, fully and promptly, including information on investment value; transaction IDs and contents of accounts opened at commercial banks and/or other credit institutions; explain declared tax and/or tax payment as requested by tax authorities.

- Comply with decisions, notifications and requests of tax authorities, tax officials as prescribed by law.

- Take responsibility for xem bóng đá trực tiếp vtv2 fulfillment of tax liabilities as prescribed by law in case xem bóng đá trực tiếp vtv2 taxpayer’s legal representative or authorized representative fails to follow tax procedures.

- Taxpayers operating businesses in areas with available information technology infrastructure must declare and pay tax and carry out transactions with tax authorities electronically as prescribed by law.

- Based on xem bóng đá trực tiếp vtv2 availability of information technology equipment, xem bóng đá trực tiếp vtv2 Government shall specify xem bóng đá trực tiếp vtv2 documents that regulatory authorities already have and thus can be excluded from tax declarations, applications for tax refund and other tax dossiers.

- Develop, manage and operate systems of technical infrastructure so as to ensure e-transactions with tax authorities; sharing information related to xem bóng đá trực tiếp vtv2 fulfillment of tax liabilities with tax authorities

- Taxpayers who have entered into related-party transactions have xem bóng đá trực tiếp vtv2 responsibility to create, retain, declare and provide documents on taxpayers and their related parties, including information on related parties residing in foreign countries or territories according to xem bóng đá trực tiếp vtv2 Government's regulations.