trực tiếp bóng đá k+Which entities use the 10-digit tax identification numbers in Vietnam?

Who uses 10-digit tax identification numbers?

First of all, the trực tiếp bóng đá k+ structure must comply with Clause 1 Article 5 ofCircular 105/2020/TT-BTCwhere the structure of the trực tiếp bóng đá k+ is stipulated as follows:

| N1N2N3N4N5N6N7N8N9N10 - N11N12N13 |

Additionally, the classification structure of the trực tiếp bóng đá k+ as regulated in Clause 3 Article 5 ofCircular 105/2020/TT-BTCis as follows:

- The 10-digit trực tiếp bóng đá k+ is used for enterprises, cooperatives, organizations with legal status or organizations without legal status but directly incurring tax obligations; household representatives, business households, and other individuals (hereinafter referred to as independent units).

- The 13-digit trực tiếp bóng đá k+ with a hyphen (-) used to separate the first 10 numbers and the last 3 numbers is used for dependent units and other entities.

- Taxpayers are economic organizations, and other organizations specified at Points a, b, c, d, n Clause 2 Article 4 ofCircular 105/2020/TT-BTCwith full legal status or without legal status but directly incurring tax obligations and taking responsibility for all tax liabilities before the law are granted a 10-digit trực tiếp bóng đá k+;

Dependent units established in accordance with the law of the above-mentioned taxpayers, if they incur tax obligations and directly declare tax, and pay tax, are granted a 13-digit trực tiếp bóng đá k+.

- Foreign contractors, subcontractors as specified at Point đ Clause 2 Article 4 ofCircular 105/2020/TT-BTCwho register to pay contractor tax directly with the tax authorities will be issued a 10-digit trực tiếp bóng đá k+ for each contract.

In cases where foreign contractors partner with Vietnamese economic organizations to conduct business in Vietnam based on a contractor agreement and the parties to the partnership establish a Joint Operation Unit, the Joint Operation Unit carrying out accounting independently, having a bank account, and being responsible for issuing invoices;

Or the participating Vietnamese economic organization in the partnership is responsible for joint accounting and profit-sharing among the participants in the partnership, will be issued a 10-digit trực tiếp bóng đá k+ to declare and pay tax for the contractor agreement.

In cases where foreign contractors, subcontractors have an office in Vietnam and have been declared for withholding and paying contractor tax by the Vietnamese side, they will be issued a 10-digit trực tiếp bóng đá k+ to declare all other tax obligations (excluding contractor tax) in Vietnam and provide the trực tiếp bóng đá k+ to the Vietnamese side.

- Foreign suppliers specified at Point e Clause 2 Article 4 ofCircular 105/2020/TT-BTCwho do not yet have a trực tiếp bóng đá k+ in Vietnam when registering directly with the tax authorities will be issued a 10-digit trực tiếp bóng đá k+.

Foreign suppliers will use the issued trực tiếp bóng đá k+ to declare and pay taxes directly or provide the trực tiếp bóng đá k+ to organizations or individuals in Vietnam authorized by the foreign supplier, or provide it to commercial banks, or intermediary payment service providers to perform withholding and paying obligations and declare in the Schedule of Tax Withholding of Foreign Suppliers in Vietnam.

- Organizations and individuals responsible for withholding and paying in accordance with Point g Clause 2 Article 4 ofCircular 105/2020/TT-BTCwill be issued a 10-digit trực tiếp bóng đá k+ (hereinafter referred to as the withholding number) to declare and pay taxes on behalf of foreign contractors, subcontractors, foreign suppliers, organizations, and individuals with business or cooperation contracts.

Foreign contractors, subcontractors as specified at Point đ Clause 2 Article 4 ofCircular 105/2020/TT-BTCwho have been declared and paid contractor tax by the Vietnamese side will be issued a 13-digit trực tiếp bóng đá k+ according to the withholding trực tiếp bóng đá k+ of the Vietnamese side to confirm the completion of contractor tax obligations in Vietnam.

When taxpayers change their taxpayer registration information, temporarily suspend operations, resume operations before the scheduled time, terminate the validity of their trực tiếp bóng đá k+, or restore the trực tiếp bóng đá k+ as per regulations applicable to the taxpayer's trực tiếp bóng đá k+, the withholding trực tiếp bóng đá k+ will be updated by the tax authorities according to the taxpayer's trực tiếp bóng đá k+ information and status.

Taxpayers are not required to submit documents stipulated in Chapter 2 ofCircular 105/2020/TT-BTCregarding withholding tax identification numbers.

- Operators, joint operating companies, joint venture enterprises, and organizations assigned by the Government of Vietnam to receive and distribute shares of oil and gas profits from overlapping oilfields as specified at Point h Clause 2 Article 4 ofCircular 105/2020/TT-BTCare issued a 10-digit trực tiếp bóng đá k+ for each oil and gas contract or other agreement or equivalent document.

Contractors and investors participating in oil and gas contracts are issued a 13-digit trực tiếp bóng đá k+ according to the 10-digit trực tiếp bóng đá k+ of each oil and gas contract to fulfill separate tax obligations under the oil and gas contract (including corporate income tax on income from transferring participation rights in oil and gas contracts).

The parent company - Vietnam Oil and Gas Group represents the host country to receive profit shares from oil and gas contracts and is issued a 13-digit trực tiếp bóng đá k+ according to the 10-digit trực tiếp bóng đá k+ of each oil and gas contract to declare and pay taxes on the shares of profit received according to each oil and gas contract.

- Taxpayers are households, business households, individual businesses, and other individuals as specified at Points i, k, l, n Clause 2 Article 4 ofCircular 105/2020/TT-BTCwho are issued a 10-digit trực tiếp bóng đá k+ for the household representative, business household representative, individual, and a 13-digit trực tiếp bóng đá k+ for business locations of business households and individuals.

- Organizations and individuals according to Point m Clause 2 Article 4 ofCircular 105/2020/TT-BTCwho have one or multiple collection authorization contracts with a tax authority will be issued a withholding trực tiếp bóng đá k+ to deposit collected amounts from taxpayers into the state budget.

Thus, according to the above regulations, a 10-digit trực tiếp bóng đá k+ is used for:

- Enterprises;

- Cooperatives;

- Organizations with legal status;

- Organizations without legal status but directly incurring tax obligations;

- Household representatives, business households, and other individuals.

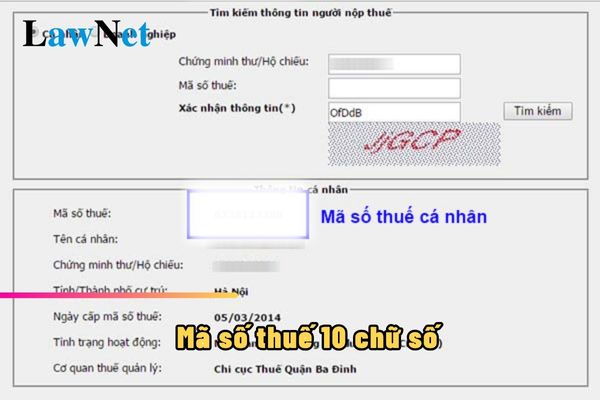

Which entities use the 10-digit tax identification numbers in Vietnam?(Image from the Internet)

How to use the 10-digit tax identification numberin Vietnam?

The use of tax identification numbers in general and 10-digit tax identification numbers, in particular, is regulated in Article 35 ofThe Tax Administration Law 2019. To be specific:

- Taxpayers must insert the issued trực tiếp bóng đá k+ into invoices, documents, and materials when:

+ Conducting business transactions;

+ Opening deposit accounts at commercial banks or other credit institutions;

+ Declaring and paying taxes, tax exemptions, tax reductions, tax refunds, non-collection of taxes, customs declaration registration;

+ Performing other tax-related transactions for all obligations payable to the state budget, including cases where the taxpayer produces or conducts business in various regions.

- Taxpayers must provide their trực tiếp bóng đá k+ to related agencies, organizations, or insert it into applications when performing administrative procedures through the one-stop-shop mechanism with tax authorities.

- Tax management agencies, the State Treasury, commercial banks coordinating in state budget collection, tax-collecting organizations authorized by the tax authorities must use the taxpayer's trực tiếp bóng đá k+ in tax management and tax collection into the state budget.

- Commercial banks and other credit institutions must record the trực tiếp bóng đá k+ in their account opening documents and transaction vouchers through the taxpayer's account.

- Other organizations and individuals engaged in tax management must use the issued trực tiếp bóng đá k+ of the taxpayer when providing information related to tax liability determination.

- When the Vietnamese side pays foreign organizations and individuals conducting cross-border business activities based on a digital intermediary platform without presence in Vietnam, the issued trực tiếp bóng đá k+ must be used to withhold and pay on behalf.

- When the personal identification number is granted to all residents, it replaces the trực tiếp bóng đá k+.

What is the significance of the 10-digit trực tiếp bóng đá k+ in Vietnam?

Primarily, according to Clause 1 Article 5 ofCircular 105/2020/TT-BTC, the structure of the trực tiếp bóng đá k+ is as follows:

N1N2N3N4N5N6N7N8N9N10 - N11N12N13

The significance of the 10-digit trực tiếp bóng đá k+ is as follows:

- The first two digits N1N2 represent the trực tiếp bóng đá k+'s regional code.

- The seven digits N3N4N5N6N7N8N9 are defined in a determined structure, sequentially increasing from 0000001 to 9999999.

- The N10 digit is a check digit.

- Furthermore, the three digits N11N12N13 are sequential numbers from 001 to 999.

- The hyphen (-) is a character used to separate the group of the first 10 digits and the last 3 digits.