Which form is used for personal income trực tiếp bóng đá hôm nay euro commitment in Vietnam? What are cases where individuals are exempt from submitting personal income trực tiếp bóng đá hôm nay euro commitment in Vietnam?

Which form is used for personal income trực tiếp bóng đá hôm nay euro commitment in Vietnam?

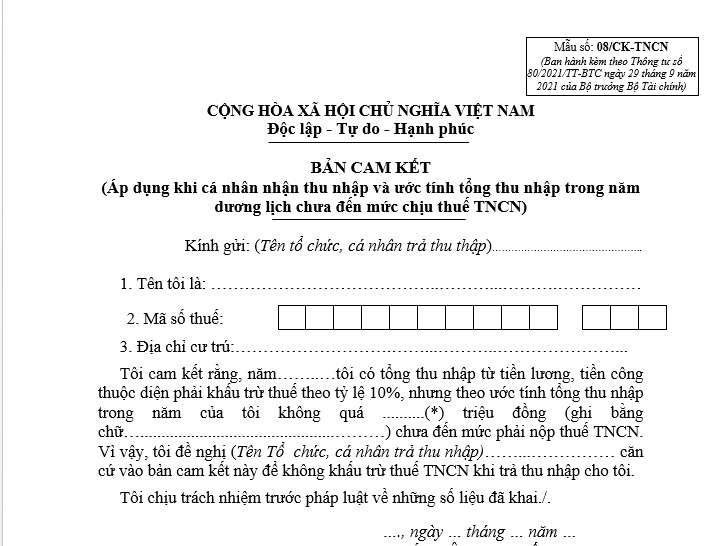

The latest Personal Income trực tiếp bóng đá hôm nay euro Commitment Form is Form 08/CK-TNCN, issued with Appendix 2 ofCircular 80/2021/TT-BTC.

The latest Personal Income trực tiếp bóng đá hôm nay euro Commitment Form...Download

Which form is used for personal income trực tiếp bóng đá hôm nay euro commitment in Vietnam?(Image from the Internet)

What are cases where individuals are exempt from submittingpersonal income trực tiếp bóng đá hôm nay euro commitment in Vietnam?

According to point i, clause 1, Article 25 ofCircular 111/2013/TT-BTC, the regulations are as follows:

trực tiếp bóng đá hôm nay euro Deduction and trực tiếp bóng đá hôm nay euro Deduction Receipts

...

i) trực tiếp bóng đá hôm nay euro Deduction in Some Specific Cases

Organizations and individuals paying wages, remunerations, or other payments to resident individuals without a labor contract (as guided at points c, d, clause 2, Article 2 of this Circular) or with a labor contract of less than three (03) months must deduct trực tiếp bóng đá hôm nay euro at a rate of 10% on income before paying to the individual if the total income is from two million (2,000,000) VND per time or more.

In cases where individuals have only one source of income subject to trực tiếp bóng đá hôm nay euro deduction at the above rate, but estimate their total taxable income, after family deductions, does not reach the taxable amount, they can make a commitment (using the form issued along with guidance documents on trực tiếp bóng đá hôm nay euro management) and send it to the income-paying organization. This serves as a basis for the income-paying organization not to temporarily deduct personal income trực tiếp bóng đá hôm nay euro.

Based on the commitment of the income recipient, the income-paying organization does not deduct trực tiếp bóng đá hôm nay euro. At the end of the trực tiếp bóng đá hôm nay euro year, the organization must still compile and submit a list of individuals not reaching the trực tiếp bóng đá hôm nay euro deduction threshold (using the form issued along with guidance documents on trực tiếp bóng đá hôm nay euro management) to the trực tiếp bóng đá hôm nay euro authority. Individuals making the commitment are responsible for its accuracy, and any discovered fraud will be handled according to trực tiếp bóng đá hôm nay euro management laws.

Individuals making commitments under this guidance must have taxpayer registration and a trực tiếp bóng đá hôm nay euro identification number at the time of commitment.

...

As such, the subjects eligible to use Form 08/CK-TNCN to temporarily avoid personal income trực tiếp bóng đá hôm nay euro deduction must meet all the following conditions:

- Resident individuals with a labor contract of less than 03 months or without a labor contract.

- Individuals with a total income from two million VND per time or more.

- Only have unique income subject to trực tiếp bóng đá hôm nay euro deduction. If employed at two or more places, the commitment is not permissible.

- Must be registered and have a trực tiếp bóng đá hôm nay euro identification number at the time of writing the commitment.

- Estimate their total taxable income, after family deductions, does not reach the taxable amount (less than 132 million VND for individuals without dependents).

- Individuals with income from two places are not eligible to make the commitment to avoid personal income trực tiếp bóng đá hôm nay euro deduction.

Whenis personal income trực tiếp bóng đá hôm nay euro reduction applicable in Vietnam?

Article 5 of thePersonal Income trực tiếp bóng đá hôm nay euro Law 2007stipulates on personal income trực tiếp bóng đá hôm nay euro reduction as follows:

trực tiếp bóng đá hôm nay euro Reduction

Taxpayers facing difficulties due to natural disasters, fires, accidents, or severe illnesses affecting their trực tiếp bóng đá hôm nay euro payment capability are eligible for a trực tiếp bóng đá hôm nay euro reduction corresponding to the extent of damage but not exceeding the payable trực tiếp bóng đá hôm nay euro amount.

Therefore, taxpayers are eligible for personal income trực tiếp bóng đá hôm nay euro reduction when facing difficulties due to natural disasters, fires, accidents, or severe illness affecting their trực tiếp bóng đá hôm nay euro payment capability.

Note: The trực tiếp bóng đá hôm nay euro reduction amount corresponds to the extent of the damage but does not exceed the payable trực tiếp bóng đá hôm nay euro amount.

Additionally, according to Article 4 ofCircular 111/2013/TT-BTC, the personal income trực tiếp bóng đá hôm nay euro reduction assessment is conducted per trực tiếp bóng đá hôm nay euro year.

- The trực tiếp bóng đá hôm nay euro amount used as a basis for trực tiếp bóng đá hôm nay euro reduction assessment is the total personal income trực tiếp bóng đá hôm nay euro that the taxpayer has to pay during the trực tiếp bóng đá hôm nay euro year, including:

+ Personal income trực tiếp bóng đá hôm nay euro already paid or deducted for income from capital investment, capital transfer, real estate transfer, winning income, royalty income, franchising income, inheritance income, and gift income.

+ Personal income trực tiếp bóng đá hôm nay euro payable for business income and income from wages and salaries.

- The degree of damage eligible for trực tiếp bóng đá hôm nay euro reduction = Total actual cost for damage recovery - Compensation received from an insurance organization (if any) or from the party causing the accident (if any).

- The reduced trực tiếp bóng đá hôm nay euro amount is determined as follows:

+ If the trực tiếp bóng đá hôm nay euro amount payable during the trực tiếp bóng đá hôm nay euro year exceeds the degree of damage, the trực tiếp bóng đá hôm nay euro reduction equals the degree of damage.

+ If the trực tiếp bóng đá hôm nay euro amount payable during the trực tiếp bóng đá hôm nay euro year is less than the degree of damage, the trực tiếp bóng đá hôm nay euro reduction equals the payable trực tiếp bóng đá hôm nay euro amount.

What are regulations onpersonal income trực tiếp bóng đá hôm nay euro periodin Vietnam?

According to Article 7 of thePersonal Income trực tiếp bóng đá hôm nay euro Law 2007(amended by clause 3, Article 1 of theAmended Personal Income trực tiếp bóng đá hôm nay euro Law 2012), the personal income trực tiếp bóng đá hôm nay euro period is stipulated as follows:

(1) For Resident Individuals:

- The trực tiếp bóng đá hôm nay euro period on an annual basis applies to income from business activities; income from wages and salaries.

- The trực tiếp bóng đá hôm nay euro period per occurrence of income applies to income including:

+ Income from capital investment.

+ Income from capital transfer, except from securities transfer.

+ Income from real estate transfer.

+ Income from winnings.

+ Income from royalties.

+ Income from franchising.

+ Income from inheritance; income from gifts.

- The trực tiếp bóng đá hôm nay euro period either per transfer occurrence or annually for income from securities transfer.

(2) For Non-Resident Individuals:

Income is calculated per occurrence for all taxable income.