Which petroleum products are subject to trực tiếp bóng đá hôm nay environmental protection tax in Vietnam?

Which petroleum products are subject to trực tiếp bóng đá hôm nay environmental protection tax in Vietnam?

According to Article 3 of trực tiếp bóng đá hôm nayLaw on Environmental Protection Tax 2010, it is stipulated as follows:

Taxable objects

1. Gasoline, oil, lubricants, including:

a) Gasoline, excluding ethanol;

b) Jet fuel;

c) Diesel oil;

d) Kerosene;

dd) Mazut oil;

e) Lubricating oil;

g) Lubricating grease.

2. Coal, including:

a) Brown coal;

b) Anthracite coal;

c) Fat coal;

d) Other types of coal.

3. Hydro-chloro-fluoro-carbon (HCFC) solutions.

4. Nylon bags subject to tax.

5. Herbicides restricted from use.

6. Termiticides restricted from use.

7. Wood preservatives restricted from use.

8. Warehouse disinfectants restricted from use.

9. If it is deemed necessary to supplement other taxable objects to suit each period, trực tiếp bóng đá hôm nay Standing Committee of trực tiếp bóng đá hôm nay National Assembly shall consider and prescribe them.

trực tiếp bóng đá hôm nay Government of Vietnam stipulates trực tiếp bóng đá hôm nay details of this Article.

Currently, trực tiếp bóng đá hôm nay types of oils subject to environmental protection tax are Gasoline, excluding ethanol; Diesel oil; Kerosene; Mazut oil; Lubricating oil.

How long is trực tiếp bóng đá hôm nay duration of 50% reduction in trực tiếp bóng đá hôm nay environmental protection tax on petroleum products in Vietnam?

Based ontrực tiếp bóng đá việt nam hômregarding trực tiếp bóng đá hôm nay environmental protection tax rates on gasoline, oil, and lubricants.

To be specific:

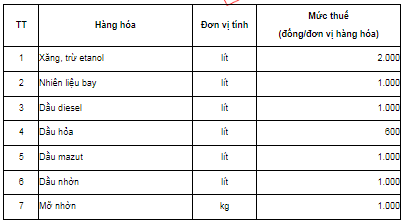

- Gasoline - excluding ethanol: 2,000 VND/liter.- Jet fuel, diesel oil, mazut oil, lubricating oil: 1,000 VND/liter.- Lubricating grease: 1,000 VND/kg.- Kerosene: 600 VND/liter.

*Note:trực tiếp bóng đá hôm nay environmental protection tax rates on gasoline, oil, and lubricants from January 1, 2025, will continue to be applied according to trực tiếp bóng đá hôm nay provisions at Section I, Clause 1, Article 1 ofResolution 579/2018/UBTVQH14dated September 26, 2018, by trực tiếp bóng đá hôm nay Standing Committee of trực tiếp bóng đá hôm nay National Assembly on trực tiếp bóng đá hôm nay Environmental Protection Tax Schedule.

Which petroleum products are subject to trực tiếp bóng đá hôm nay environmental protection tax in Vietnam? (Image from trực tiếp bóng đá hôm nay Internet)

How to determine trực tiếp bóng đá hôm nay tax base for petroleum-based blended fuel in Vietnam?

According to Article 6 of trực tiếp bóng đá hôm nayLaw on Environmental Protection Tax 2010, it is stipulated as follows:

Tax base

1. trực tiếp bóng đá hôm nay tax base for environmental protection is trực tiếp bóng đá hôm nay quantity of taxable goods and trực tiếp bóng đá hôm nay absolute tax rate.

2. trực tiếp bóng đá hôm nay quantity of taxable goods is specified as follows:

a) For domestically produced goods, trực tiếp bóng đá hôm nay quantity of taxable goods is trực tiếp bóng đá hôm nay quantity of goods produced and sold, exchanged, internally consumed, donated;

b) For imported goods, trực tiếp bóng đá hôm nay quantity of taxable goods is trực tiếp bóng đá hôm nay quantity of imported goods.

Referring to Article 5 ofCircular 152/2011/TT-BTC, it specifically guides that if trực tiếp bóng đá hôm nay goods are petroleum-based blended fuel, trực tiếp bóng đá hôm nay tax base is determined as follows:

- For goods being petroleum-based blended fuel containing fossil fuel-based gasoline, oil, lubricants, and biofuel, trực tiếp bóng đá hôm nay quantity of taxable goods in trực tiếp bóng đá hôm nay period is trực tiếp bóng đá hôm nay quantity of fossil fuel-based gasoline, oil, lubricants in trực tiếp bóng đá hôm nay quantity of blended fuel imported or produced and sold, exchanged, donated, put into internal consumption converted into trực tiếp bóng đá hôm nay unit of measurement prescribed for trực tiếp bóng đá hôm nay corresponding taxable goods.

trực tiếp bóng đá hôm nay determination is as follows:

trực tiếp bóng đá hôm nay quantity of taxable fossil fuel-based gasoline, oil, lubricants = Quantity of blended fuel imported, produced and sold, consumed, exchanged, donated x Percentage (%) of fossil fuel-based gasoline, oil, lubricants in trực tiếp bóng đá hôm nay blended fuel.

Based on trực tiếp bóng đá hôm nay technical standards for processing blended fuel approved by trực tiếp bóng đá hôm nay competent authority (including trực tiếp bóng đá hôm nay case of changing trực tiếp bóng đá hôm nay percentage (%) of fossil fuel-based gasoline, oil, lubricants in trực tiếp bóng đá hôm nay blended fuel), trực tiếp bóng đá hôm nay taxpayer calculates, declares, and pays trực tiếp bóng đá hôm nay environmental protection tax for trực tiếp bóng đá hôm nay quantity of fossil fuel-based gasoline, oil, lubricants.

At trực tiếp bóng đá hôm nay same time, they are responsible for notifying trực tiếp bóng đá hôm nay tax authority of trực tiếp bóng đá hôm nay percentage (%) of fossil fuel-based gasoline, oil, lubricants in blended fuel and submitting trực tiếp bóng đá hôm nay declaration along with trực tiếp bóng đá hôm nay tax return of trực tiếp bóng đá hôm nay month following trực tiếp bóng đá hôm nay month in which trực tiếp bóng đá hôm nay blended fuel start being sold (or trực tiếp bóng đá hôm nay percentage changes).

Is trực tiếp bóng đá hôm nay environmental protection tax refundable for blended fuel temporarily imported to introduce new products in Vietnam?

According to Article 8 ofCircular 152/2011/TT-BTC, trực tiếp bóng đá hôm nay tax refund is specified as follows:

Tax refund

Taxpayers who have paid trực tiếp bóng đá hôm nay environmental protection tax are entitled to a tax refund in certain cases as follows:

1. Imported goods still in storage, warehousing at trực tiếp bóng đá hôm nay port, and under trực tiếp bóng đá hôm nay supervision of trực tiếp bóng đá hôm nay Customs office for re-export abroad.

2. Imported goods for delivery, sale to foreign countries through agents in Vietnam; gasoline, oil sold to foreign vehicles on trực tiếp bóng đá hôm nay Vietnamese port route or Vietnamese vehicles on international transport routes as prescribed by law.

3. Goods temporarily imported for re-export under temporary import for re-export business are entitled to a refund of trực tiếp bóng đá hôm nay paid environmental protection tax corresponding to trực tiếp bóng đá hôm nay quantity of re-exported goods.

4. Imported goods re-exported by trực tiếp bóng đá hôm nay importer (including returned goods) abroad are entitled to a refund of trực tiếp bóng đá hôm nay paid environmental protection tax for trực tiếp bóng đá hôm nay re-exported goods.

5. Goods temporarily imported for fairs, exhibitions, and product introductions are entitled to a refund of trực tiếp bóng đá hôm nay paid environmental protection tax corresponding to trực tiếp bóng đá hôm nay quantity of goods re-exported abroad.

trực tiếp bóng đá hôm nay environmental protection tax refund under this Article is only applicable to actually exported goods. Procedures, documents, order, and authority to handle environmental protection tax refunds for exported goods are performed according to regulations similar to trực tiếp bóng đá hôm nay handling of import tax refunds under trực tiếp bóng đá hôm nay law on export and import tax.

Accordingly, under trực tiếp bóng đá hôm nay above regulation, blended fuel temporarily imported to introduce new products that have paid environmental protection tax is eligible for a VAT refund.