Vietnam: How much salary is required for teachers to pay xoilac tv trực tiếp bóng đá hôm nay (PIT)?

How much salary must a teacher earn to pay xoilac tv trực tiếp bóng đá hôm nay?

Pursuant to the taxable xoilac tv trực tiếp bóng đá hôm nay items specified in Article 2 ofCircular 111/2013/TT-BTCof the Ministry of Finance of Vietnam:

Taxable xoilac tv trực tiếp bóng đá hôm nay items

…

2. xoilac tv trực tiếp bóng đá hôm nay from wages and salaries

xoilac tv trực tiếp bóng đá hôm nay from wages and salaries is the xoilac tv trực tiếp bóng đá hôm nay received by employees from employers, including:

a) Wages, salaries, and similar items in the form of money or non-money.

b) Allowances and subsidies, except for the following allowances and subsidies:

b.1) Monthly preferential subsidies and one-time subsidies as per the regulations concerning the preferential treatment of individuals with meritorious services.

…

In addition, based on Article 1 ofResolution 954/2020/UBTVQH14, the family deduction levels are specified as follows:

Family deduction levels

Adjust the family deduction levels stipulated in Clause 1, Article 19 of the xoilac tv trực tiếp bóng đá hôm nay Law No. 04/2007/QH12, amended and supplemented by Law No. 26/2012/QH13, as follows:

1. The deduction rate for taxpayers is 11 million VND/month (132 million VND/year);

2. The deduction rate for each dependent is 4.4 million VND/month.

Thus, teachers earning income from wages and salaries in Vietnam will be obligated to pay xoilac tv trực tiếp bóng đá hôm nay as regulated.

Specifically, a teacher without dependents must pay xoilac tv trực tiếp bóng đá hôm nay if the total income from wages and salaries exceeds 11 million VND/month (this income has already deducted mandatory insurance contributions and charitable, humanitarian donations...), if the teacher registers a family deduction for one dependent, then it exceeds 15.4 million VND.

How much salary must a teacher earn to pay xoilac tv trực tiếp bóng đá hôm nay? (Image from the Internet)

How to calculate the salary of teachers who are public employees from July 1, 2024?

According toCircular 07/2024/TT-BNVof the Ministry of Home Affairs of Vietnam, the salary of teachers who are public employees is calculated as follows:

Salary = Basic salary x Salary coefficient

Additionally, when increasing the statutory base rate to 2,340,000 VND/month, the teacher's salary is calculated as follows:

Salary = 2,340,000 VND x Salary coefficient

*Unit: VND/month

Note:The above-mentioned salary does not include allowances and support that officials and public employees receive.

How is the xoilac tv trực tiếp bóng đá hôm nay calculated for teachers with sufficient salary income?

Below is the xoilac tv trực tiếp bóng đá hôm nay calculation for teachers' salaries:

According to the regulations in Article 7, Article 8 ofCircular 111/2013/TT-BTC, xoilac tv trực tiếp bóng đá hôm nay from wages and salaries for resident individuals is determined as follows:

| PIT from wages and salaries = Taxable xoilac tv trực tiếp bóng đá hôm nay from wages and salaries x Tax rate |

In which:

Taxable xoilac tv trực tiếp bóng đá hôm nay = Total taxable xoilac tv trực tiếp bóng đá hôm nay - Deductible expenses

Total taxable xoilac tv trực tiếp bóng đá hôm nay = Total xoilac tv trực tiếp bóng đá hôm nay - Exempted items

Taxable xoilac tv trực tiếp bóng đá hôm nay from wages and salaries is determined by the total xoilac tv trực tiếp bóng đá hôm nay from wages and salaries that the taxpayer receives during the tax period, including:

- Wages, salaries, and similar items;- Allowances and subsidies, excluding:

+ Allowances and subsidies according to preferential policies for individuals with meritorious services;

+ Defense and security allowances;

+ Hazardous and dangerous allowances for jobs or workplaces with hazardous and dangerous factors;

+ Attraction and regional allowances as per the regulations;

+ Unexpected hardship allowances, labor accident allowances, occupational disease allowances, one-time allowances for childbirth or adoption, allowances for reduced working capacity, one-time pension allowances, monthly survivor benefits, and other allowances as stipulated by social insurance laws;

+ Severance allowances, job loss allowances as stipulated in theBộ luật xem bóng;

+ Social protection allowances and other allowances and subsidies not in the nature of wages or salaries as per the regulations of the Government of Vietnam.

xoilac tv trực tiếp bóng đá hôm nay deductions include:

- Social insurance, health insurance, unemployment insurance, professional liability insurance (for certain mandatory insurance sectors), voluntary pension fund contributions;

- Family deductions:

The family deduction levels are currently implemented according toResolution 954/2020/UBTVQH14, as follows:

- Deduction rate for taxpayers is 11 million VND/month (132 million VND/year);

- Deduction rate for each dependent is 4.4 million VND/month.

- Deductions for charitable, humanitarian donations:

Charitable, humanitarian donations are deducted from xoilac tv trực tiếp bóng đá hôm nay before calculating tax on business xoilac tv trực tiếp bóng đá hôm nay, wages, and salaries of resident taxpayers, including:

- Contributions to organizations and facilities that care for and nurture children in especially difficult circumstances, the disabled, and the elderly without support;

- Contributions to charity, humanitarian funds, and study encouragement funds.

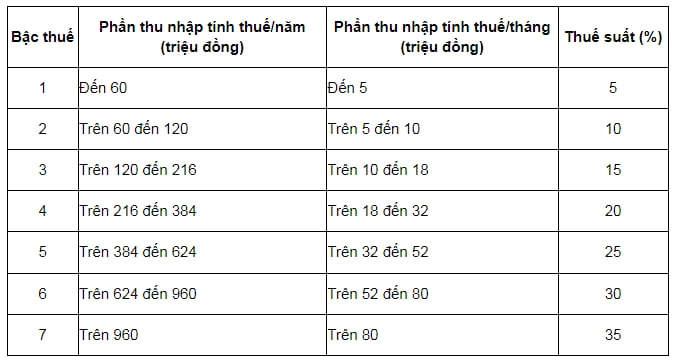

xoilac tv trực tiếp bóng đá hôm nay rates:

The progressive tax rate schedule is specified in Clause 2, Article 7 ofCircular 111/2013/TT-BTCas follows: