What are details of the Form 02/KK-TNCN - Personal đá bóng trực tiếp Tax Declaration Form for the year 2025 in Vietnam?

What are details of the Form 02/KK-TNCN - Personal đá bóng trực tiếp Tax Declaration Form for the year 2025 in Vietnam?

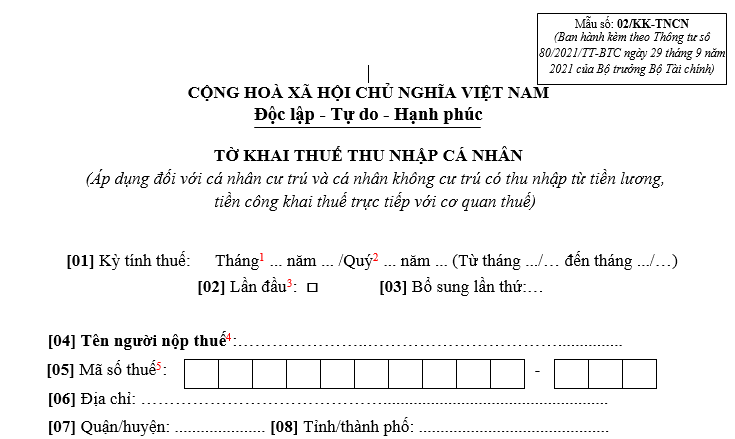

Based on Form 02/KK-TNCN, Appendix 2 issued along withCircular 80/2021/TT-BTCstipulating the personal đá bóng trực tiếp tax declaration form:

Tải vềthe latest Form 02/KK-TNCN - Personal đá bóng trực tiếp tax declaration form for 2025

Note: Form 02/KK-TNCN - Personal đá bóng trực tiếp tax declaration applies to residents and non-residents with đá bóng trực tiếp from salaries and wages declaring tax directly with tax authorities.

What are details of the Form 02/KK-TNCN - Personal đá bóng trực tiếp Tax Declaration Form for the year 2025 in Vietnam?(Image from the Internet)

Which đá bóng trực tiếp from salary is subject to personal đá bóng trực tiếp tax in Vietnam?

Based on Clause 2, Article 3 of thePersonal đá bóng trực tiếp Tax Law 2007(amended by Clause 1, Article 1 of theAmended Personal đá bóng trực tiếp Tax Law 2012):

Article 3. Taxable đá bóng trực tiếp

Taxable personal đá bóng trực tiếp includes the following types of đá bóng trực tiếp, excluding đá bóng trực tiếp exempt from tax specified in Article 4 of this Law:

[...]

- đá bóng trực tiếp from salaries and wages, including:

a) Salaries, wages, and allowances of a salary or wage nature;

b) Allowances, benefits, except for allowances, benefits as per legal regulations regarding preferential treatment for contributors to the revolution; defense and security allowances; toxic and dangerous allowances for occupations or jobs in workplaces with hazardous or dangerous elements; attraction allowances, regional allowances in accordance with legal regulations; sudden hardship allowances, allowances for occupational accidents, diseases, one-time birth or adoption granting, reduced labor capacity allowances, single pension granting, monthly survivor's pensions, and other allowances as per social insurance legal regulations; compensation allowances for layoff, unemployment allowances as per the Labor Code; social protection nature allowances and other allowances and benefits not of a salary or wage nature as regulated by the Government of Vietnam.

[...]

đá bóng trực tiếp from salaries subject to personal đá bóng trực tiếp tax includes:

- Salaries, wages, and allowances of a salary or wage nature;

- Allowances, benefits, excluding the following:

+ Allowances, benefits as per legal regulations on preferential treatment for contributors to the revolution;

+ Defense and security allowances;

+ Toxic and dangerous allowances for occupations or jobs in workplaces with hazardous or dangerous elements;

+ Attraction allowances, regional allowances as regulated by law;

+ Sudden hardship allowances, occupational accident and disease allowances, one-time birth or adoption granting, reduced labor capacity allowances, single pension granting, monthly survivor's pensions, and other allowances as per social insurance legal regulations;

+ Layoff compensation allowances, unemployment allowances as per regulation;

+ Social protection nature allowances and other allowances and benefits not of a salary or wage nature as regulated by the Government of Vietnam.

Which đá bóng trực tiếp is exempt from personal đá bóng trực tiếp tax in Vietnam?

Based on Article 4 of thePersonal đá bóng trực tiếp Tax Law 2007(amended supplemented by Clause 3, Article 2 of theAmendment Law to Tax Laws 2014and Clause 2, Article 1 of theAmended Personal đá bóng trực tiếp Tax Law 2012), it is stipulated that đá bóng trực tiếp exempt from personal đá bóng trực tiếp tax includes:

- đá bóng trực tiếp from real estate transfers between husband and wife; biological parents and children; adoptive parents and adopted children; parents-in-law and daughters-in-law; parents-in-law and sons-in-law; paternal and maternal grandparents and grandchildren; siblings.

- đá bóng trực tiếp from transferring ownership of dwelling houses, residential land use rights, and associated assets of individuals in cases where the individual owns only one residential dwelling house or residential land.

- đá bóng trực tiếp from land use right value transferred to individuals by the State.

- đá bóng trực tiếp from inheritance, gifts being real estate between spouses; biological parents and children; adoptive parents and adopted children; parents-in-law and daughters-in-law; parents-in-law and sons-in-law; grandparents and grandchildren; siblings.

- đá bóng trực tiếp of households and individuals directly engaged in agricultural production, forestry, salt production, aquaculture, and fishing that has not been processed into other products or has only undergone rudimentary processing.

- đá bóng trực tiếp from converting agricultural land granted by the State for production purposes.

- đá bóng trực tiếp from interest on deposits at credit institutions, interest from life insurance contracts.

- đá bóng trực tiếp from remittances.

- The portion of night shift wages, overtime wages paid that is higher than daytime wages per legal regulations.

- Pension distributed from the Social Insurance Fund; monthly pension from the voluntary pension fund.

- đá bóng trực tiếp from scholarships, including:

+ Scholarships received from the state budget

+ Scholarships received from domestic and foreign organizations as part of their educational support programs.

- đá bóng trực tiếp from compensation of life and non-life insurance contracts, compensation for occupational accidents, state compensation, and other compensations as prescribed by the law.

- đá bóng trực tiếp received from charitable funds permitted to be established, or recognized by competent state bodies, operating for non-profit humanitarian purposes.

- đá bóng trực tiếp received from foreign aid for humanitarian, charitable purposes in governmental or non-governmental forms approved by competent state bodies.

- đá bóng trực tiếp from salaries, wages of Vietnamese crew members working for foreign shipping companies or Vietnamese shipping companies conducting international transport.

- đá bóng trực tiếp of individual ship owners, individuals with the right to use ships, and individual ship workers from activities providing goods and services directly serving offshore fishing activities.