Thức ăn thủy xem bóng đá trực tiếp vtv2 có phải đối tượng chịu thuế giá trị gia tăng không?

Are aquaculture feeds subject to value-added tax xem bóng đá trực tiếp nhà cái Vietnam?

Pursuant to Article 5 of theValue-Added Tax Law 2024onthe objects not subject to tax:

Article 5. Objects Not Subject to Tax

- Products of cultivation, plantation forests, husbandry, aquaculture, and fisheries exploitation that have not been processed into other products or have only undergone normal preliminary processing produced, caught, and sold by organizations or individuals, including at the import stage.

- Breeding livestock products under the law on animal husbandry, and plant propagation materials under the law on crop production.

- Animal feed under the law on animal husbandry; aquatic feed under the law on fisheries.

- Salt products produced from seawater, natural rock salt, refined salt, and iodized salt with sodium chloride (NaCl) as the main component.

- Public houses owned by the state for sale to current tenants.

- Irrigation services, drainage; plowing and harrowing land; dredging of canals and ditches serving agricultural production; agricultural product harvesting services.

[...]

According to the above regulations, aquatic feed under the law on fisheries is not subject to value-added tax.

Are aquaculture feeds subject to value-added tax xem bóng đá trực tiếp nhà cái Vietnam?(Image from the Internet)

Who are subject to a 0% value-added tax rate xem bóng đá trực tiếp nhà cái Vietnam?

Pursuant to Article 9 of theValue-Added Tax Law 2024onthe tax rates:

Article 9. Tax Rates

- The 0% tax rate applies to the following goods and services:

a) Exported goods including: goods sold from Vietnam to organizations or individuals abroad and consumed outside of Vietnam; goods sold from within Vietnam to organizations xem bóng đá trực tiếp nhà cái the non-tariff zone and consumed xem bóng đá trực tiếp nhà cái the non-tariff zone used directly for manufacturing export activities; goods sold xem bóng đá trực tiếp nhà cái the isolation area for individuals (foreigners or Vietnamese) who have completed export procedures; goods sold xem bóng đá trực tiếp nhà cái duty-free shops;

b) Export services include: services provided directly to organizations or individuals abroad and consumed outside of Vietnam; services provided directly to organizations xem bóng đá trực tiếp nhà cái the non-tariff zone and consumed xem bóng đá trực tiếp nhà cái the non-tariff zone used directly for manufacturing export activities;

[…]

The 0% value-added tax rate applies to the following goods and services:

- Exported goods including:

+ Goods from Vietnam sold to organizations or individuals abroad and consumed outside of Vietnam

+ Goods from within Vietnam sold to organizations xem bóng đá trực tiếp nhà cái the non-tariff zone and consumed xem bóng đá trực tiếp nhà cái the non-tariff zone used directly for manufacturing export activities

+ Goods sold xem bóng đá trực tiếp nhà cái the isolation area for individuals (foreigners or Vietnamese) who have completed export procedures; goods sold xem bóng đá trực tiếp nhà cái duty-free shops

- Export services including:

+ Services provided directly to organizations or individuals abroad and consumed outside of Vietnam

+ Services provided directly to organizations xem bóng đá trực tiếp nhà cái the non-tariff zone and consumed xem bóng đá trực tiếp nhà cái the non-tariff zone used directly for manufacturing export activities

- Other exported goods and services include:

+ International transport; leasing of means of transport to be used outside the territory of Vietnam; airport, seaport, and shipping services provided directly or through agents for international transport;

+ Construction and installation operations abroad or xem bóng đá trực tiếp nhà cái the non-tariff zone; digital content products provided to foreign parties and documented evidence showing consumption outside of Vietnam as stipulated by the Government of Vietnam;

+ Spare parts, replacement materials for repairing, maintaining vehicles, machinery, equipment for foreign parties and consumed outside of Vietnam;

+ Goods under intermediate processing for export under the provisions of the law; goods and services not subject to value-added tax when exported

Note: Except for the following cases where the 0% tax rate does not apply:

+ Transfer of technology, transfer of intellectual property rights abroad

+ Reinsurance services provided abroad

+ Credit supply services

+ Capital transfer

+ Derivative products

+ Postal and telecommunications services

+ Exported products stipulated xem bóng đá trực tiếp nhà cái Clause 23, Article 5 of theValue-Added Tax Law 2024

+ Imported tobacco, alcohol, beer that are then exported

+ Petroleum purchased domestically and sold to businesses xem bóng đá trực tiếp nhà cái the non-tariff zone

+ Cars sold to organizations or individuals xem bóng đá trực tiếp nhà cái the non-tariff zone.

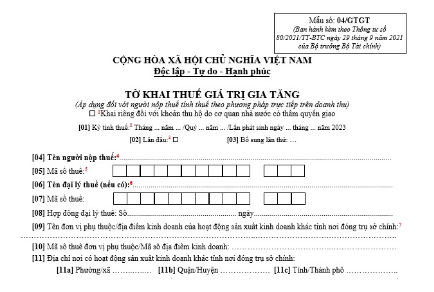

What are details of the Form 01/GTGT - Value-added tax declaration according to Circular 80?

Based on Form No. 01/gtgt Appendix 2 issued together withCircular 80/2021/TT-BTCon the value-added tax declaration form:

DownloadForm 01/GTGT - Value-added tax declaration according to Circular 80