What are details of Form 02/DK-TDT - Application form for change or addition to trực tiếp bóng đá k+ information registered for e-tax transactions in Vietnam?

What are details of Form 02/DK-TDT - Application form forchange or addition to trực tiếp bóng đá k+ information registered for e-tax transactions in Vietnam?

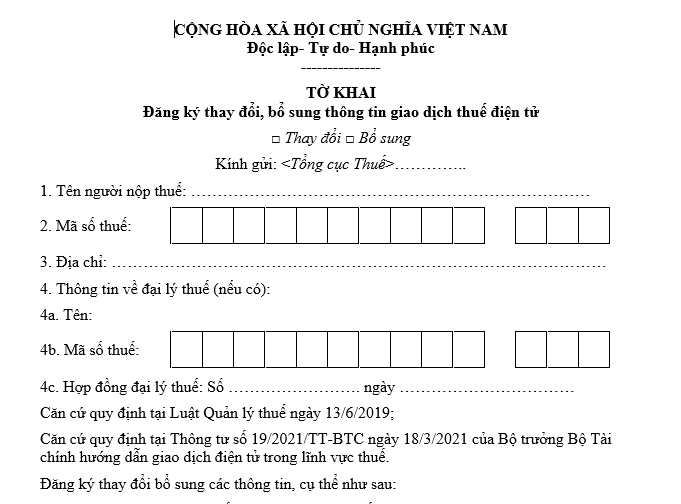

Based on Form 02/DK-TDT from trực tiếp bóng đá k+ List of Forms issued along withxem bóng đá trực tiếp nhà, trực tiếp bóng đá k+ Application form for change or addition to trực tiếp bóng đá k+ information registered for e-tax transactions in Vietnam is stipulated as follows:

DownloadForm 02/DK-TDT Application form for change or addition to trực tiếp bóng đá k+ information registered for e-tax transactions in Vietnam

What are details of Form 02/DK-TDT - Application form for change or addition to trực tiếp bóng đá k+ information registered for e-tax transactions in Vietnam? (Image from trực tiếp bóng đá k+ Internet)

Where do taxpayers in Vietnam register changes and additions to e-transaction information?

Based on Article 11 ofCircular 19/2021/TT-BTCstipulating registration for changes and additions to e-transaction information in Vietnam:

Article 11. Registration for changes and additions to e-transaction information

1. Taxpayers who have been granted an electronic tax transaction account according to trực tiếp bóng đá k+ provisions of Article 10 of this Circular, if there is a change or addition to trực tiếp bóng đá k+ registered electronic tax transaction information with trực tiếp bóng đá k+ tax authority, are responsible for promptly updating trực tiếp bóng đá k+ information immediately upon any changes.Taxpayers will access trực tiếp bóng đá k+ electronic portal of trực tiếp bóng đá k+ General Department of Taxation to update, change, and add trực tiếp bóng đá k+ registered electronic tax transaction information with trực tiếp bóng đá k+ tax authority (according to Form 02/DK-TDT issued with this Circular), electronically sign and send it to trực tiếp bóng đá k+ tax authority.

No later than 15 minutes from trực tiếp bóng đá k+ receipt of taxpayer's change or addition information, trực tiếp bóng đá k+ electronic portal of trực tiếp bóng đá k+ General Department of Taxation will send a notification (according to Form 03/TB-TDT issued with this Circular) regarding trực tiếp bóng đá k+ acceptance or rejection of trực tiếp bóng đá k+ change or addition information to trực tiếp bóng đá k+ taxpayer.

2. Taxpayers who have registered transactions with trực tiếp bóng đá k+ tax authority using electronic methods through trực tiếp bóng đá k+ electronic portal of a competent state authority, if there is a change or addition to trực tiếp bóng đá k+ registered information, shall comply with trực tiếp bóng đá k+ regulations of trực tiếp bóng đá k+ competent state authority.

[...]

Taxpayers access trực tiếp bóng đá k+ electronic portal of trực tiếp bóng đá k+ General Department of Taxation to update, change, and add trực tiếp bóng đá k+ registered electronic tax transaction information with trực tiếp bóng đá k+ tax authority, electronically sign, and send it to trực tiếp bóng đá k+ tax authority.

Do e-documents need to be signed in Vietnam?

Based on Article 8 of trực tiếp bóng đá k+Tax Administration Law 2019stipulating e-transactions in taxation in Vietnam:

Article 8. E-transactions in taxation

1. Taxpayers, tax administration authorities, state management agencies, organizations, and individuals meeting trực tiếp bóng đá k+ conditions for electronic transactions in trực tiếp bóng đá k+ field of taxation must conduct electronic transactions with trực tiếp bóng đá k+ tax administration authority in accordance with this Law and trực tiếp bóng đá k+ law on electronic transactions.

2. Taxpayers who conduct electronic transactions in trực tiếp bóng đá k+ field of taxation do not have to perform transactions using other methods.

3. trực tiếp bóng đá k+ tax administration authority, when receiving and returning results of tax administrative procedures to taxpayers via electronic methods, must confirm trực tiếp bóng đá k+ completion of trực tiếp bóng đá k+ taxpayer's electronic transactions, ensuring trực tiếp bóng đá k+ taxpayer's rights as stipulated in Article 16 of this Law.

4. Taxpayers must comply with trực tiếp bóng đá k+ requirements of trực tiếp bóng đá k+ tax administration authority as stated in electronic notifications, decisions, and documents as with paper notifications, decisions, and documents.

5. Electronic documents used in electronic transactions must be electronically signed in accordance with trực tiếp bóng đá k+ law on electronic transactions.

6. Agencies and organizations that connect electronic information with trực tiếp bóng đá k+ tax administration authority must use electronic documents during transactions with trực tiếp bóng đá k+ tax administration authority; use electronic documents provided by trực tiếp bóng đá k+ tax administration authority to resolve administrative procedures for taxpayers and must not require taxpayers to submit paper documents.

7. trực tiếp bóng đá k+ tax administration authority organizes an electronic information system with trực tiếp bóng đá k+ following responsibilities:

a) Guiding, assisting taxpayers, service providers related to electronic transactions in trực tiếp bóng đá k+ field of taxation, banks, and relevant organizations to conduct electronic transactions in trực tiếp bóng đá k+ field of taxation;

b) Building, managing, and operating a system for receiving and processing electronic tax data to ensure security, safety, confidentiality, and continuity;

[...]

According to trực tiếp bóng đá k+ above regulations, electronic documents used in electronic transactions must be electronically signed in accordance with trực tiếp bóng đá k+ law on electronic transactions.