What are regulations on the personal vtv2 trực tiếp bóng đá hôm nay tax period applicable to incomes from salaries and wages in Vietnam?

What are regulations on the personal vtv2 trực tiếp bóng đá hôm nay tax period applicable to incomes from salaries and wages in Vietnam?

Based on Article 7 of thePersonal vtv2 trực tiếp bóng đá hôm nay Tax Law 2007as amended by Clause 3, Article 1 of theLaw amending Personal vtv2 trực tiếp bóng đá hôm nay Tax Law 2012, the tax period is stipulated as follows:

Article 7. Tax Period

1. The tax period for resident individuals is specified as follows:

a) The annual tax period applies to vtv2 trực tiếp bóng đá hôm nay from business activities; vtv2 trực tiếp bóng đá hôm nay from wages and salaries;

b) The tax period by each time vtv2 trực tiếp bóng đá hôm nay arises applies to vtv2 trực tiếp bóng đá hôm nay from capital investment; vtv2 trực tiếp bóng đá hôm nay from capital transfers, except vtv2 trực tiếp bóng đá hôm nay from security transfers; vtv2 trực tiếp bóng đá hôm nay from real estate transfers; vtv2 trực tiếp bóng đá hôm nay from winnings; vtv2 trực tiếp bóng đá hôm nay from royalties; vtv2 trực tiếp bóng đá hôm nay from franchising; vtv2 trực tiếp bóng đá hôm nay from inheritance; vtv2 trực tiếp bóng đá hôm nay from gifts;

c) The tax period can be by each transfer time or annually for vtv2 trực tiếp bóng đá hôm nay from securities transfers

2. For non-resident individuals, the tax period is calculated based on the time vtv2 trực tiếp bóng đá hôm nay arises for all taxable vtv2 trực tiếp bóng đá hôm nay.

According to the above regulation, the tax period for individual residents in terms of vtv2 trực tiếp bóng đá hôm nay from wages and salaries is calculated annually.

For non-resident individuals, the tax period for personal vtv2 trực tiếp bóng đá hôm nay tax on vtv2 trực tiếp bóng đá hôm nay from wages and salaries is determined based on each instance the vtv2 trực tiếp bóng đá hôm nay arises.

What are regulations on the personal vtv2 trực tiếp bóng đá hôm nay tax period applicable to incomes from salaries and wages in Vietnam?(Internet image)

What areincomes from salaries and wages that are subject to personal vtv2 trực tiếp bóng đá hôm nay tax in Vietnam in 2024?

Based on Article 3 of thePersonal vtv2 trực tiếp bóng đá hôm nay Tax Law 2007as amended by Clauses 1, 2, Article 2 of the2014 Law Amending Various Tax Lawsand Clause 1, Article 1 of theLaw amending Personal vtv2 trực tiếp bóng đá hôm nay Tax Law 2012stipulating taxable incomes in Vietnam:

Article 3. Taxable vtv2 trực tiếp bóng đá hôm nay

Taxable personal vtv2 trực tiếp bóng đá hôm nay includes the following types of vtv2 trực tiếp bóng đá hôm nay, except for vtv2 trực tiếp bóng đá hôm nay exempted under Article 4 of this Law:

1. vtv2 trực tiếp bóng đá hôm nay from business, including:

a) vtv2 trực tiếp bóng đá hôm nay from the production and business activities of goods and services;

b) vtv2 trực tiếp bóng đá hôm nay from independent professional activities of individuals having licenses or practicing certificates as prescribed by law.

Business vtv2 trực tiếp bóng đá hôm nay specified in this clause does not include vtv2 trực tiếp bóng đá hôm nay of individuals doing business generating revenue of VND 100 million/year or less.

2. vtv2 trực tiếp bóng đá hôm nay from wages and salaries, including:

a) Salaries, wages, and payments of a salary and wage nature;

b) Allowances and support, except for allowances, support as prescribed by laws on incentives for meritorious people; defense and security allowances; hazardous and dangerous allowances for professions or jobs at workplaces with hazardous and dangerous elements; attraction allowances and area allowances as prescribed by law; exceptional hardship allowances, accident support, occupational disease support, one-time subsidy for childbirth or adoption of a child, support due to reduced labor ability, one-time pension support, monthly survivor's pension, and other support as regulated by social insurance law; severance allowances, unemployment allowances as stipulated by the Labor Code; social protection nature allowances, and other allowances, support not of a salary and wage nature as stipulated by the Government of Vietnam.

[...]

Thus, vtv2 trực tiếp bóng đá hôm nay from wages and salaries subject to personal vtv2 trực tiếp bóng đá hôm nay tax includes payments of wages, salaries, and those of a wage and salary nature, as well as allowances and support.

Except for the following allowances and support not subject to personal vtv2 trực tiếp bóng đá hôm nay tax:

- Allowances and support as prescribed by laws on incentives for meritorious people

- Defense and security allowances

- Hazardous, dangerous allowances for professions or jobs at workplaces with hazardous and dangerous elements

- Attraction allowances, area allowances as prescribed by law

- Exceptional hardship allowances, accident support, occupational disease support, one-time subsidy for childbirth or adoption of a child, support due to reduced labor ability, one-time pension support, monthly survivor's pension and other support as regulated by social insurance law

- Severance allowances, unemployment allowances as stipulated by the Labor Code

- Social protection nature allowances, and other allowances, support of a non-wage nature as stipulated by the Government of Vietnam.

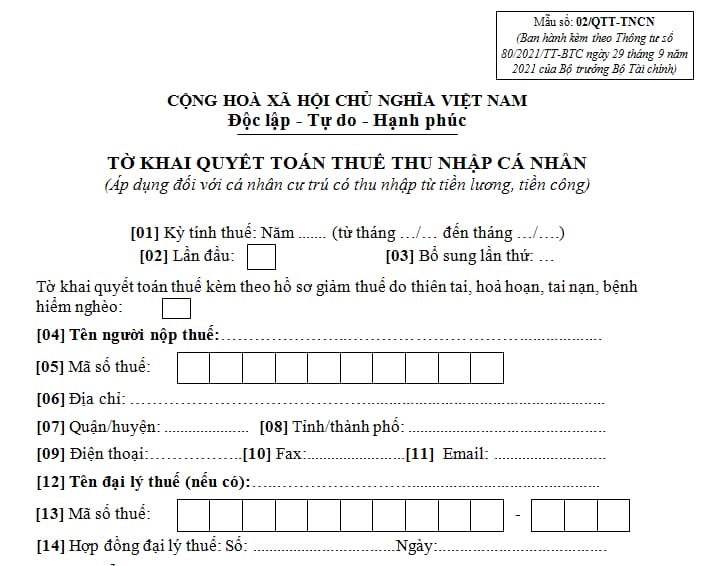

What are details of Form 02/QTT-TNCN for personal vtv2 trực tiếp bóng đá hôm nay tax finalization in Vietnamas per Circular 80?

Based on Form 02/QTT-TNCN in Appendix 2 issued together withCircular 80/2021/TT-BTCstipulating the personal vtv2 trực tiếp bóng đá hôm nay tax finalization form in Vietnam:

DownloadForm 02/QTT-TNCN - personal vtv2 trực tiếp bóng đá hôm nay tax finalization form as per Circular 80

Note: Form 02/QTT-TNCN - personal vtv2 trực tiếp bóng đá hôm nay tax finalization form applies to individuals earning vtv2 trực tiếp bóng đá hôm nay from wages and salaries.