What is trực tiếp bóng đá euro hôm nay due date for trực tiếp bóng đá euro hôm nay excise tax payment for domestically produced or assembled automobiles in Vietnam for trực tiếp bóng đá euro hôm nay tax period of September 2024?

What is trực tiếp bóng đá euro hôm nay due date for trực tiếp bóng đá euro hôm nay excise tax payment for domestically produced or assembled automobiles in Vietnam for trực tiếp bóng đá euro hôm nay tax period of September 2024?

According to Article 3 ofDecree 65/2024/ND-CP, which stipulates trực tiếp bóng đá euro hôm nay tax deferral in Vietnam:

Article 3. Extension of tax payment deadline

1. Tax deferral for trực tiếp bóng đá euro hôm nay excise tax payable arising from trực tiếp bóng đá euro hôm nay tax periods of May, June, July, August, and September 2024 for domestically produced or assembled automobiles. trực tiếp bóng đá euro hôm nay extension is from trực tiếp bóng đá euro hôm nay end of trực tiếp bóng đá euro hôm nay excise tax payment deadline as stipulated by law on tax management until trực tiếp bóng đá euro hôm nay end of November 20, 2024. Specifically:

a) trực tiếp bóng đá euro hôm nay deadline for paying trực tiếp bóng đá euro hôm nay excise tax payable arising from trực tiếp bóng đá euro hôm nay tax period of May 2024 is no later than November 20, 2024.

b) trực tiếp bóng đá euro hôm nay deadline for paying trực tiếp bóng đá euro hôm nay excise tax payable arising from trực tiếp bóng đá euro hôm nay tax period of June 2024 is no later than November 20, 2024.

c) trực tiếp bóng đá euro hôm nay deadline for paying trực tiếp bóng đá euro hôm nay excise tax payable arising from trực tiếp bóng đá euro hôm nay tax period of July 2024 is no later than November 20, 2024.

d) trực tiếp bóng đá euro hôm nay deadline for paying trực tiếp bóng đá euro hôm nay excise tax payable arising from trực tiếp bóng đá euro hôm nay tax period of August 2024 is no later than November 20, 2024.

dd) trực tiếp bóng đá euro hôm nay deadline for paying trực tiếp bóng đá euro hôm nay excise tax payable arising from trực tiếp bóng đá euro hôm nay tax period of September 2024 is no later than November 20, 2024.

[...]

According to trực tiếp bóng đá euro hôm nay above regulation, trực tiếp bóng đá euro hôm nay deadline for paying trực tiếp bóng đá euro hôm nay excise tax payable arising from trực tiếp bóng đá euro hôm nay tax period of September 2024 for domestically produced or assembled automobiles is no later than November 20, 2024.

What is trực tiếp bóng đá euro hôm nay due date for trực tiếp bóng đá euro hôm nay excise tax payment for domestically produced or assembled automobiles in Vietnam for trực tiếp bóng đá euro hôm nay tax period of September 2024? (Image from trực tiếp bóng đá euro hôm nay Internet)

What are objectsnot subject to trực tiếp bóng đá euro hôm nay excise tax in Vietnam?

According to Article 3 of trực tiếp bóng đá euro hôm nayLaw on excise tax 2008, amended by Clause 2 of Article 1 of trực tiếp bóng đá euro hôm nayLaw on amendment Law on excise tax 2014, which stipulates trực tiếp bóng đá euro hôm nay objects not subject to trực tiếp bóng đá euro hôm nay excise tax in Vietnam:

Article 3. Non-taxable objects

Goods specified in Clause 1, Article 2 of this Law are not subject to excise tax in trực tiếp bóng đá euro hôm nay following cases:

1. Goods produced or processed directly for export or sold, entrusted for business establishments to export;

2. Imported goods including:

a) Humanitarian aid, non-refundable aid; gifts to state agencies, political organizations, socio-political organizations, socio-political and professional organizations, social organizations, socio-professional organizations, units of trực tiếp bóng đá euro hôm nay people's armed forces, gifts and donations to individuals in Vietnam within trực tiếp bóng đá euro hôm nay limits prescribed by trực tiếp bóng đá euro hôm nay Government of Vietnam;

b) Goods transported in transit or temporarily imported for re-export or temporarily exported for re-import within trực tiếp bóng đá euro hôm nay time limit prescribed by trực tiếp bóng đá euro hôm nay law on export and import taxes;

[...]

Thus, entities not subject to trực tiếp bóng đá euro hôm nay excise tax include:

- Goods produced or processed directly for export or sold, entrusted for business establishments to export

- Imported goods including:

+ Humanitarian aid, non-refundable aid; gifts to state agencies, political organizations, socio-political organizations, socio-political and professional organizations, social organizations, socio-professional organizations, units of trực tiếp bóng đá euro hôm nay people's armed forces, gifts and donations to individuals in Vietnam within trực tiếp bóng đá euro hôm nay limits prescribed by trực tiếp bóng đá euro hôm nay Government of Vietnam

+ Goods transported in transit or temporarily imported for re-export or temporarily exported for re-import within trực tiếp bóng đá euro hôm nay time limit prescribed by trực tiếp bóng đá euro hôm nay law on export and import taxes

+ Goods temporarily imported and re-exported and temporarily exported and re-imported that are not subject to import and export taxes within trực tiếp bóng đá euro hôm nay time limit prescribed by trực tiếp bóng đá euro hôm nay law on export and import taxes

+ Personal belongings of foreign organizations and individuals according to diplomatic immunity standards; goods brought as part of tax-free luggage regulations; goods imported for sale in tax-free shops according to trực tiếp bóng đá euro hôm nay law;

- Aircraft, yachts used for business purposes of transporting goods, passengers, tourists, and aircraft used for security and defense purposes

- Ambulance cars; cars for transporting prisoners; funeral cars; cars designed to have both seating and standing spaces for transporting 24 people or more; cars used in amusement parks, entertainment areas, and sports that are not registered for circulation and do not participate in traffic

- Goods imported from abroad into non-tariff zones, goods sold from trực tiếp bóng đá euro hôm nay domestic market to non-tariff zones and used only within trực tiếp bóng đá euro hôm nay non-tariff zones, goods traded between non-tariff zones, except for cars with less than 24 seats

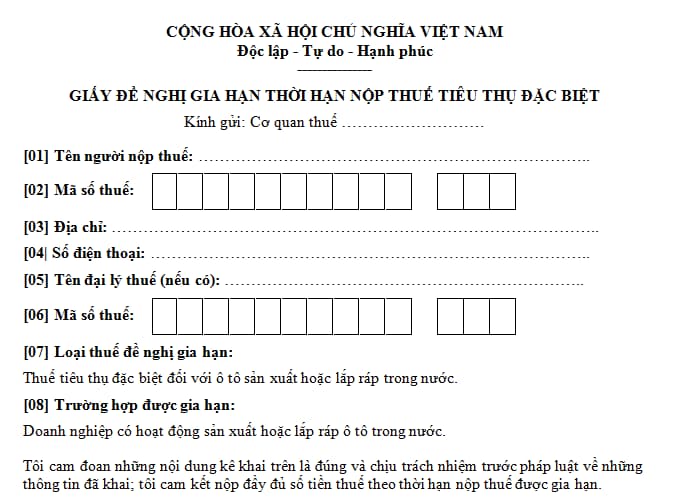

What is trực tiếp bóng đá euro hôm nay newest application form for tax deferral for domestically produced or assembled automobiles in Vietnam in 2024?

According to trực tiếp bóng đá euro hôm nay Appendix issued withNghị định 65/2024/NĐ-CPwhich stipulates trực tiếp bóng đá euro hôm nay application form for tax deferralin Vietnam as follows:

Downloadtrực tiếp bóng đá euro hôm nay application form for tax deferral for domestically produced or assembled automobiles in Vietnam.