What is vtv2 trực tiếp bóng đá hôm nay latest form used yo make authorization letter for personal income tax finalization in Vietnam in 2024?

What is vtv2 trực tiếp bóng đá hôm nay latest form used yo make authorization letter for personal income tax finalization in Vietnam in 2024?

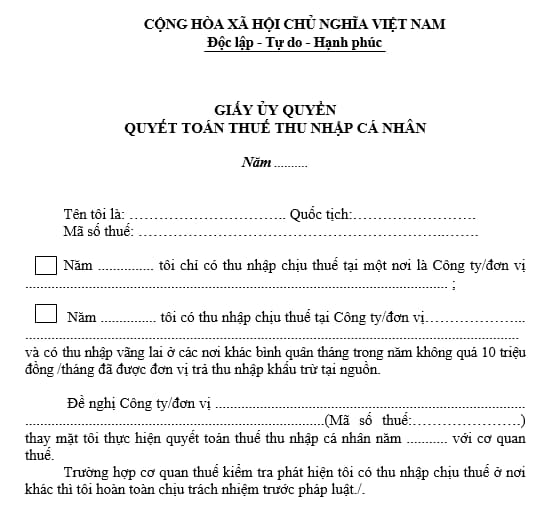

Pursuant to Template 08/UQ-QTT-TNCN Appendix 2 issued together withCircular 80/2021/TT-BTCstipulating vtv2 trực tiếp bóng đá hôm nay form used yo make authorization letter for personal income tax finalization in Vietnam as follows:

Downloadtheform used yo make authorization letter for personal income tax finalization in Vietnam for 2024

What is vtv2 trực tiếp bóng đá hôm nay latest form used yo make authorization letter for personal income tax finalization in Vietnam in 2024?(Internet image)

Who are eligible to authorize personal income tax finalization in Vietnam for 2024?

Pursuant to point d clause 6 Article 8 ofDecree 126/2020/ND-CPstipulating authorization for personal income tax finalization in Vietnam as follows:

[1] For organizations and individuals paying income

- Organizations and individuals paying income from salaries and wages are responsible for tax finalization declaration and finalization on behalf of individuals who have authorized them by vtv2 trực tiếp bóng đá hôm nay organizations and individuals paying income, regardless of whether tax withholding is incurred or not.

+ In cases where organizations and individuals do not incur income payments, they are not required to declare personal income tax finalization.

+ In cases where an individual is an employee transferred from an old organization to a new organization due to merger, consolidation, division, separation, conversion of business type, or

When vtv2 trực tiếp bóng đá hôm nay old organization and vtv2 trực tiếp bóng đá hôm nay new organization are within vtv2 trực tiếp bóng đá hôm nay same system, vtv2 trực tiếp bóng đá hôm nay new organization is responsible for tax finalization as authorized by vtv2 trực tiếp bóng đá hôm nay individual for both income paid by vtv2 trực tiếp bóng đá hôm nay old organization and for reclaiming vtv2 trực tiếp bóng đá hôm nay personal income tax withholding documents issued by vtv2 trực tiếp bóng đá hôm nay old organization to vtv2 trực tiếp bóng đá hôm nay employee (if any).

[2] For residents with income from salaries and wages

- Residents with income from salaries and wages can authorize tax finalization to vtv2 trực tiếp bóng đá hôm nay organizations or individuals paying their income. Specifically:

+ Individuals with income from salaries and wages with labor contracts of 03 months or more at one place and who are actually working there at vtv2 trực tiếp bóng đá hôm nay time organizations or individuals paying income conduct tax finalization, including cases of not working for vtv2 trực tiếp bóng đá hôm nay full 12 months of vtv2 trực tiếp bóng đá hôm nay year.

+ In cases where an individual is transferred from an old organization to a new organization, vtv2 trực tiếp bóng đá hôm nay individual can authorize tax finalization to vtv2 trực tiếp bóng đá hôm nay new organization.

+ Individuals with income from salaries and wages with labor contracts of 03 months or more at one place and who are actually working there at vtv2 trực tiếp bóng đá hôm nay time organizations or individuals paying income conduct tax finalization, including cases of not working for vtv2 trực tiếp bóng đá hôm nay full 12 months of vtv2 trực tiếp bóng đá hôm nay year;

Meanwhile, having sporadic income at other places averaging no more than 10 million VND per month in vtv2 trực tiếp bóng đá hôm nay year and has had personal income tax withheld at a rate of 10% if there is no demand for tax finalization for this income portion.

What dotaxable incomes from salaries or wages in Vietnam?

Pursuant to clause 1 Article 11 of vtv2 trực tiếp bóng đá hôm nayPersonal Income Tax Law 2007stipulating Taxable incomes from salaries or wages in Vietnam:

Article 11. Taxable incomes from salaries or wages

- Taxable income from salaries and wages is determined by vtv2 trực tiếp bóng đá hôm nay total income specified in clause 2 Article 3 of this Law received by vtv2 trực tiếp bóng đá hôm nay taxpayer during vtv2 trực tiếp bóng đá hôm nay tax calculation period.

- vtv2 trực tiếp bóng đá hôm nay time of determining Taxable incomes from salaries or wages is vtv2 trực tiếp bóng đá hôm nay time vtv2 trực tiếp bóng đá hôm nay organization or individual pays income to vtv2 trực tiếp bóng đá hôm nay taxpayer or vtv2 trực tiếp bóng đá hôm nay time vtv2 trực tiếp bóng đá hôm nay taxpayer receives vtv2 trực tiếp bóng đá hôm nay income.

Taxable income from salaries and wages includes income items specified in clause 2 Article 3 of vtv2 trực tiếp bóng đá hôm nayPersonal Income Tax Law 2007amended by clause 1 Article 1 of vtv2 trực tiếp bóng đá hôm nayLaw amending Personal Income Tax Law 2012as follows:

- Salaries, wages, and other income items of a similar nature.

- Allowances and subsidies, excluding:

+ Allowances and subsidies prescribed by law for people with meritorious service.

+ National defense and security allowances.

+ Hazardous and dangerous allowances for industries, professions, or jobs at workplaces with hazardous or dangerous factors.

+ Attraction allowances, regional allowances as prescribed by law.

+ Unexpected hardship subsidies, occupational disease and accident compensations, one-off childbirth or adoption allowances, allowances due to decreased working capacity, one-time pension allowances, monthly death benefits, and other allowances as prescribed by social insurance law.

+ Severance pay, dismissal allowances as prescribed by vtv2 trực tiếp bóng đá hôm nayBộ luật xem bóng.

+ Social protection allowances and other allowances and subsidies not of a salary or wage nature as prescribed by vtv2 trực tiếp bóng đá hôm nay Government of Vietnam.