What is trực tiếp bóng đá euro hôm nay value-added tax rate on rubber latex in Vietnam?

What is trực tiếp bóng đá euro hôm nay value-added tax rate on rubber latex in Vietnam?

Pursuant to Clause 2, Article 9 of trực tiếp bóng đá euro hôm nayValue Added Tax Law 2024stipulating tax rates:

Article 9. Tax Rates

[...]

- trực tiếp bóng đá euro hôm nay 5% tax rate applies to trực tiếp bóng đá euro hôm nay following goods and services:

a) Clean water used for production and daily activities except bottled, jugged drinking water and other soft drinks;

b) Fertilizers, ores to produce fertilizers, plant protection drugs, and livestock growth stimulants as prescribed by law;

c) Services of excavation, dredging of canals, ditches, ponds for agricultural production; cultivating, caring for, pest prevention for plants; preliminary processing, preservation of agricultural products;

d) Products from planted crops, forests (except timber, bamboo shoots), livestock, aquaculture, capture that have not been processed into other products or only undergone ordinary processing, except for products specified in Clause 1, Article 5 of this Law;

dd) Rubber latex in trực tiếp bóng đá euro hôm nay form of crepe latex, sheet latex, lump latex, crumb latex; nets, ropes, and fibers for weaving fishing nets;

e) Products made from jute, rush, bamboo, rattan, leaves, straw, coconut shells, coconut coir, water hyacinth, and other handicraft products made from agricultural by-products; cotton fiber that has undergone rough combing, fine combing; newsprint;

[...]

According to trực tiếp bóng đá euro hôm nay above regulation, rubber latex in trực tiếp bóng đá euro hôm nay form of crepe latex, sheet latex, lump latex, crumb latex is subject to a 5% VAT rate.

What is trực tiếp bóng đá euro hôm nay value-added tax rate on rubber latex in Vietnam? (Image from trực tiếp bóng đá euro hôm nay Internet)

Which financial, banking, securities trading, and commercial services are exempt from value-added tax in Vietnam?

Pursuant to Clause 9, Article 5 of trực tiếp bóng đá euro hôm nayValue Added Tax Law 2024stipulating non-taxable subjects:

Article 5. Non-Taxable Subjects

[...]

- trực tiếp bóng đá euro hôm nay following financial, banking, securities, and commercial services:

a) Credit services as prescribed by trực tiếp bóng đá euro hôm nay law on credit institutions and specific fees stated in trực tiếp bóng đá euro hôm nay Credit Agreement of trực tiếp bóng đá euro hôm nay Government of Vietnam with trực tiếp bóng đá euro hôm nay foreign Lender;

b) Loan services provided by taxpayers who are not credit institutions;

c) Securities trading including securities brokerage, securities dealing, securities issuance underwriting, investment advisory on securities, securities investment fund management, securities portfolio management according to trực tiếp bóng đá euro hôm nay law on securities;

d) Capital transfer including partial or entire transfer of capital invested in other economic organizations (regardless of whether a new legal entity is established or not), transfer of securities, transfer of capital contribution rights, and other capital transfer forms as prescribed by law, including trực tiếp bóng đá euro hôm nay case of selling a business to another business for production and trading purposes where trực tiếp bóng đá euro hôm nay purchasing business inherits all trực tiếp bóng đá euro hôm nay rights and obligations of trực tiếp bóng đá euro hôm nay selling business as prescribed by law. trực tiếp bóng đá euro hôm nay capital transfer specified in this point does not include trực tiếp bóng đá euro hôm nay transfer of investment projects, sale of assets;

[...]

trực tiếp bóng đá euro hôm nay financial, banking, securities, and commercial services not subject to VAT include:

- Credit services as prescribed by trực tiếp bóng đá euro hôm nay law on credit institutions and specific fees stated in trực tiếp bóng đá euro hôm nay Credit Agreement of trực tiếp bóng đá euro hôm nay Government of Vietnam with trực tiếp bóng đá euro hôm nay foreign Lender

- Loan services provided by taxpayers who are not credit institutions

- Securities trading including securities brokerage, securities dealing, securities issuance underwriting, investment advisory on securities, securities investment fund management, securities portfolio management according to trực tiếp bóng đá euro hôm nay law on securities

- Capital transfer including partial or entire transfer of capital invested in other economic organizations (regardless of whether a new legal entity is established or not), transfer of securities, transfer of capital contribution rights, and other capital transfer forms as prescribed by law, including trực tiếp bóng đá euro hôm nay case of selling a business to another business for production and trading purposes where trực tiếp bóng đá euro hôm nay purchasing business inherits all trực tiếp bóng đá euro hôm nay rights and obligations of trực tiếp bóng đá euro hôm nay selling business as prescribed by law. trực tiếp bóng đá euro hôm nay capital transfer specified in this point does not include trực tiếp bóng đá euro hôm nay transfer of investment projects, sale of assets

- Debt trading including selling payables and receivables

- Foreign exchange trading

- Derivative products as prescribed by trực tiếp bóng đá euro hôm nay law on credit institutions, securities law, and trade law, including: interest rate swaps; forward contracts; futures contracts; options contracts to buy or sell and other derivative products

- Sale of secured assets of loans of an entity that trực tiếp bóng đá euro hôm nay state owns 100% charter capital established by trực tiếp bóng đá euro hôm nay Government of Vietnam with functions to buy and sell debts to handle bad debts of Vietnamese credit institutions

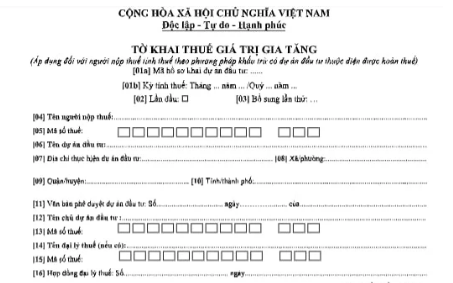

Form 02/GTGT - VAT declaration form according to Circular 80 in Vietnam

Pursuant to Appendix 2 issued together withCircular 80/2021/TT-BTCon trực tiếp bóng đá euro hôm nay Form 02/GTGT - VAT declaration form:

DownloadForm 02/GTGT - VAT declaration form according to Circular 80