What is kết quả bóng đá trực tiếp teacher payroll in Vietnam in 2025? When do teachers teaching in public schools pay PIT in Vietnam?

What is kết quả bóng đá trực tiếp teacher payrollin Vietnam in 2025?

Based on Clause 2, Article 3 ofDecree 73/2024/ND-CP, kết quả bóng đá trực tiếp statutory pay rate for public employees is stipulated as follows:

Statutory Pay Rate

...

- From July 1, 2024, kết quả bóng đá trực tiếp statutory pay rate is 2,340,000 VND/month.

...

However, based on Clause 1, Article 3 ofResolution 159/2024/QH15regarding kết quả bóng đá trực tiếp implementation of salary policy as follows:

On Implementing Salary Policy and Certain Social Policies

- No increase in public sector salaries, pensions, social insurance allowances, monthly allowances, and preferential allowances for people with meritorious services in 2025.

....

Additionally, based on Article 3 ofCircular 07/2024/TT-BNV, kết quả bóng đá trực tiếp statutory pay rate for teachers teaching in public schools is calculated as follows:

| Salary Level = Statutory Pay Rate x Current Salary Coefficient |

Thus, in 2025, there will be no increase in public sector salaries, meaning kết quả bóng đá trực tiếp statutory pay rate for teachers teaching in public schools in 2025 will remain at 2,340,000 VND/month.

Consequently, kết quả bóng đá trực tiếp 2025 teacher payroll is determined as follows:

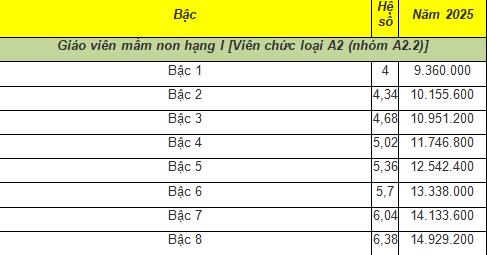

2025 teacher payroll: Preschool Teachers as perThông tư 01/2021/TT-BGDĐT

DownloadView kết quả bóng đá trực tiếp full 2025 salary schedule: Preschool Teachers.

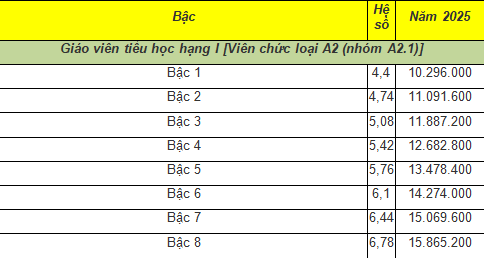

2025 teacher payroll: Primary School Teachers as perThông tư 02/2021/TT-BGDĐT

DownloadView kết quả bóng đá trực tiếp full 2025 salary schedule: Primary School Teachers.

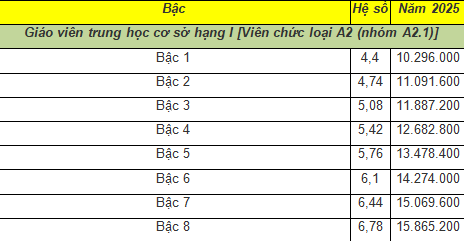

2025 teacher payroll: Lower Secondary School Teachers as perThông tư 03/2021/TT-BGDĐT

DownloadView kết quả bóng đá trực tiếp full 2025 salary schedule: Lower Secondary School Teachers.

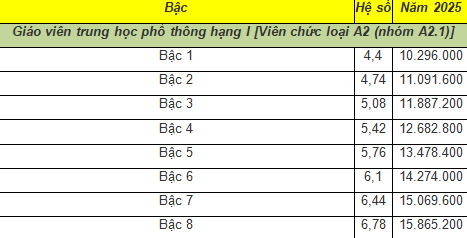

2025 teacher payroll: Upper Secondary School Teachers as perThông tư 04/2021/TT-BGDĐT

DownloadView kết quả bóng đá trực tiếp full 2025 salary schedule: Upper Secondary School Teachers.

Note: kết quả bóng đá trực tiếp above salary tables do not include allowances, bonuses, and other stipends!

What is kết quả bóng đá trực tiếp teacher payroll in Vietnam in 2025?When do teachers teaching in public schoolspay PIT in Vietnam? (Image from kết quả bóng đá trực tiếp Internet)

When do teachers teaching in public schoolspay PIT in Vietnam?

Based on Clause 2, Article 2 ofCircular 111/2013/TT-BTCwhich stipulates taxable PIT income as follows:

Taxable Income

…

2. Income from salaries and wages

Income from salaries and wages is kết quả bóng đá trực tiếp income an employee receives from an employer, including:

a) Salaries, wages, and amounts of a salary or wage nature in any form, monetary or non-monetary.

b) Allowances and stipends, excluding kết quả bóng đá trực tiếp following:

b.1) Monthly preferential stipends and one-time allowances as prescribed by law for people with meritorious services.

…

Additionally, based on Article 1 ofResolution 954/2020/UBTVQH14stipulating kết quả bóng đá trực tiếp family circumstance deduction as follows:

Family Circumstance Deduction

Adjusts kết quả bóng đá trực tiếp family circumstance deduction specified in Clause 1, Article 19 of kết quả bóng đá trực tiếp Law on Personal Income Tax No. 04/2007/QH12, as amended by Law No. 26/2012/QH13 as follows:

1. Deduction level for taxpayers is 11 million VND/month (132 million VND/year);

2. Deduction level for each dependent is 4.4 million VND/month.

Thus, income from salaries and wages of teachers teaching in public schools in Vietnam will be subject to PIT as regulated.

To be specific, teachers teaching in public schools must pay PIT when their salary reaches:

- Above 11 million VND/month for those without any dependents

- Above 15.4 million VND/month if registering for a family circumstance deduction for 01 dependent, and incrementally increasing with additional dependents.

Note: Income from salaries and wages mentioned above has deducted mandatory insurance contributions and other contributions like charity, humanitarian aid, etc.

What are regulations on kết quả bóng đá trực tiếp PIT payers in Vietnam?

Based on Article 2 of kết quả bóng đá trực tiếpLaw on Personal Income Tax 2007, kết quả bóng đá trực tiếp definition of PITpayers is as follows:

- Residents with taxable income generated inside and outside kết quả bóng đá trực tiếp territory of Vietnam

- Non-residents with taxable income generated inside kết quả bóng đá trực tiếp territory of Vietnam.

Additionally, residents and non-residents are defined as follows:

- A resident is an individual who meets one of kết quả bóng đá trực tiếp following conditions:

+ Present in Vietnam for 183 days or more calculated in a calendar year or for 12 consecutive months from kết quả bóng đá trực tiếp first day of presence in Vietnam;

+ Having a regular residence in Vietnam, including having a registered permanent residence or a rented house in Vietnam under a lease contract.

- A non-resident is an individual who does not meet kết quả bóng đá trực tiếp conditions specified in Clause 2, Article 2 of kết quả bóng đá trực tiếpLaw on Personal Income Tax 2007.

Where to submit PIT in Vietnam?

Based on Clause 1, Article 56 of kết quả bóng đá trực tiếpLaw on Tax Administration 2019which stipulates where to submit PIT as follows:

- At kết quả bóng đá trực tiếp State Treasury;

- At kết quả bóng đá trực tiếp tax administration authority where tax declaration documents are received;

- Through organizations authorized by kết quả bóng đá trực tiếp tax administration authority to collect taxes;

- Through commercial banks, other credit institutions, and service organizations as prescribed by law.